The $500K to $1M segment leads the way in another strong month of home sales

Despite the Thanksgiving holiday, the Houston housing never skipped a beat in November as buyers steered the market through positive territory even as inventory hovered at historically low levels. Renters also brought much-needed business back to the lease market following slight declines in October.

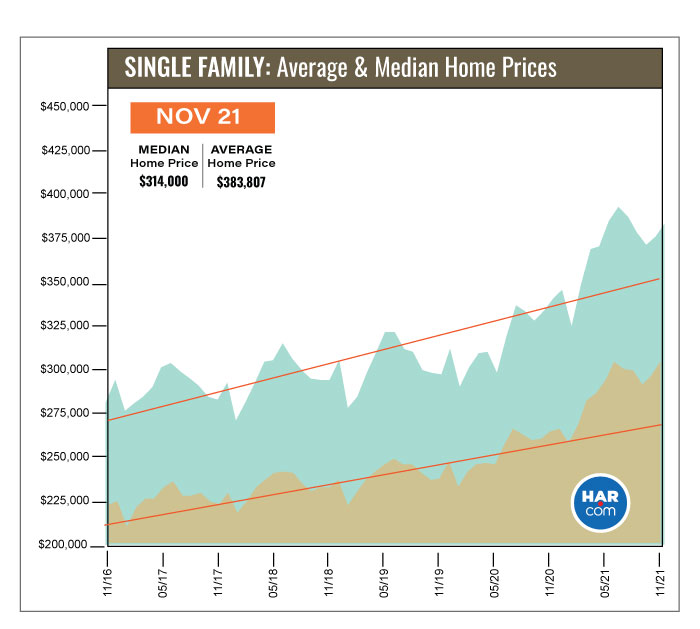

According to the Houston Association of REALTORS® (HAR) November 2021 Market Update, single-family homes sales rose 3.9 percent compared to last November, with 8,320 units sold. That is up from 8,010 sales in 2020. On a year-to-date basis, local home sales are 12.0 percent ahead of 2020’s record pace and up 22.2 percent versus 2019, the previous record-setting year.

As in October, homes in the $500,000 to $1 million price range drew the greatest sales volume increase for the month, registering a 49.1 percent year-over-year gain. The $250,000 to $500,000 housing segment came in second place with a 26.2 percent rise. That was followed by the luxury segment, which consists of homes priced from $1 million and above. It rose 23.4 percent over its November 2020 level.

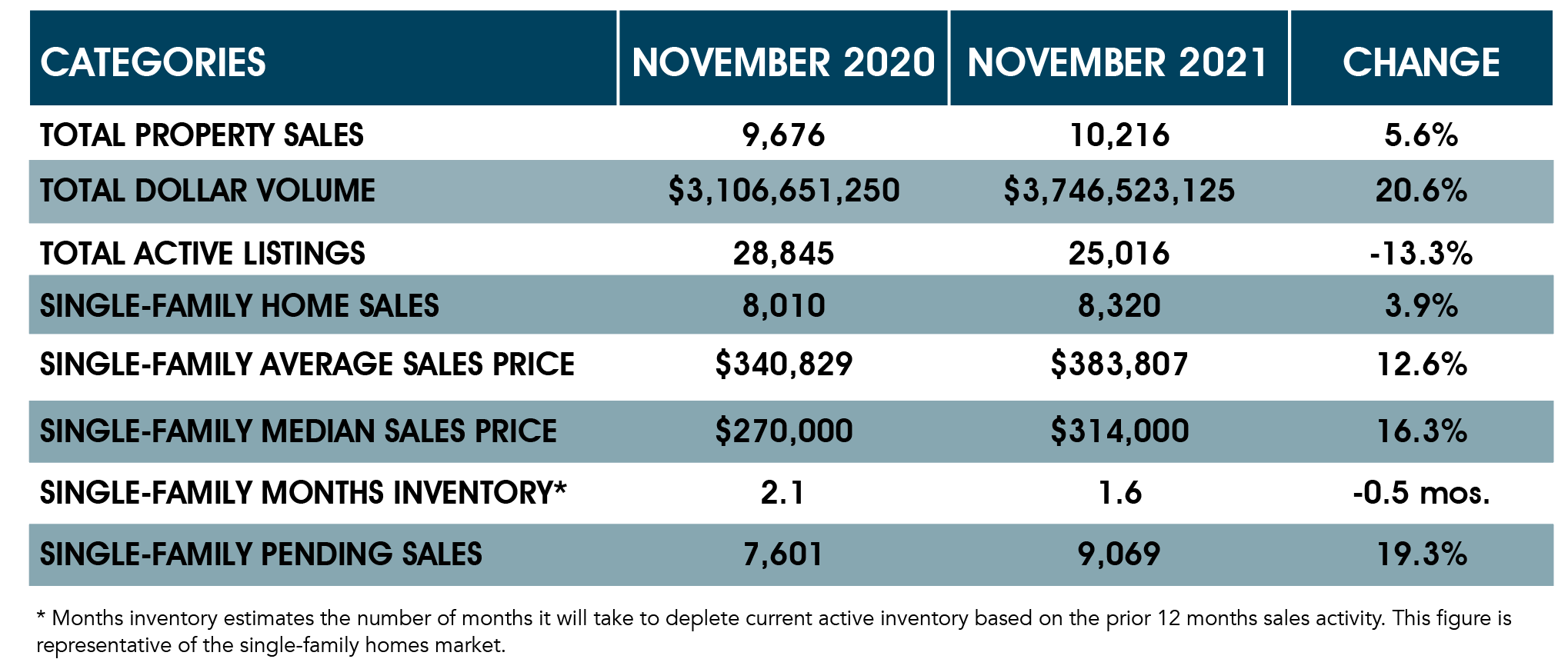

The heavy volume of high-end buying and lack of inventory of homes under $250,000 pushed overall prices upward. The average price of a single-family home rose 12.6 percent to $383,807 while the median price rose 16.3 percent to tie the record high $314,000 it originally reached in June 2021.

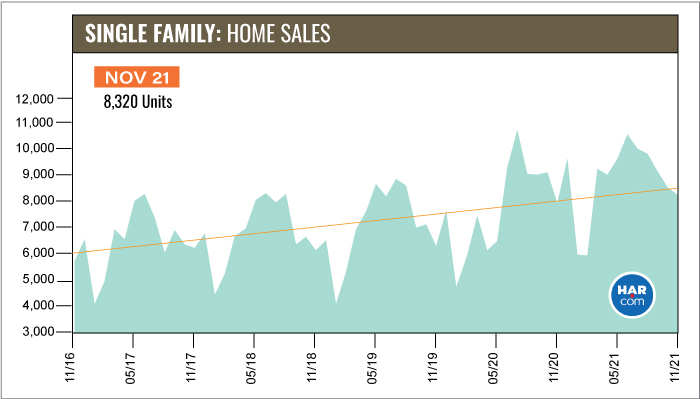

Sales of all property types were up 5.6 percent year-over-year, totaling 10,216, and total dollar volume for November jumped 20.6 percent to $3.7 billion.

“Throughout the pandemic, the Houston housing market has been unpredictably strong and November was no exception,” said HAR Chairman Richard Miranda with Keller Williams Platinum. “We remain on track for a record 2021, and the Greater Houston Partnership (GHP) sees positive conditions for local employment going into 2022, which is good news for real estate.”

In the November 2021 edition of The Economy at a Glance, GHP reported the following: “The region’s workforce continues to recover. Approximately 280,000 Houstonians (on net) dropped out of the labor force in the early stages of the pandemic. All but 55,000 have returned. Houstonians who stood on the sidelines are rejoining the workforce. Young adults coming of age are entering the labor market. And workers from other metros and other countries are moving here for job opportunities.”

Lease Property Update

Houston’s lease market enjoyed robust activity in November following a mixed performance in October. Single-family lease homes rose 7.1 percent year-over-year. Leases of townhomes and condominiums increased 5.1 percent. The average single-family rent climbed 8.5 percent to $2,042 while the average rent for townhomes and condominiums increased 3.8 percent to $1,737.

November Monthly Market Comparison

After a slight decline in home sales in October, Houston real estate rebounded in November, with single-family home sales up 3.9 percent year-over-year. Most of the other monthly measurements were positive, too. Pending sales jumped 19.3 percent. However, total active listings — or the total number of available properties —remained down 13.3 percent compared to 2020 as a result of strong buying trends throughout most of this year.

Single-family homes inventory edged downward to a 1.6-months supply versus 2.1 months last November. Since August, inventory had been holding at 1.8-months – the market’s greatest supply of homes for all of 2021. Housing inventory nationally stands at a 2.4-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Single-family home sales rose 3.9 percent in November with 8,320 units sold across the greater Houston area compared to 8,010 a year earlier. Strong sales volume among homes at the high end of the market drove up pricing. The median price climbed 16.3 percent to tie its record high of $314,000 originally reached in June 2021. The average price rose 12.6 percent to $383,807, the third highest price of all time.

Days on Market, or the actual time it took to sell a home, fell from 46 to 35 days. Inventory registered a 1.6-months supply compared to 2.1 months a year earlier. This came after holding at a 1.8-months supply from August through October 2021. The current national inventory figure stands at 2.4 months, as reported by NAR.

Broken out by housing segment, November sales performed as follows:

- $1 – $99,999: decreased 23.9 percent

- $100,000 – $149,999: decreased 27.1 percent

- $150,000 – $249,999: decreased 33.5 percent

- $250,000 – $499,999: increased 26.2 percent

- $500,000 – $999,999: increased 49.1 percent

- $1M and above: increased 23.4 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 6,873 in November. That was up 9.5 percent from the same month last year. The average sales price rose 12.9 percent to $382,199 while the median sales price climbed 15.7 percent to $305,000.

For HAR’s Monthly Activity Snapshot (MAS) of the November 2021 trends, please click HERE to access a downloadable PDF file.

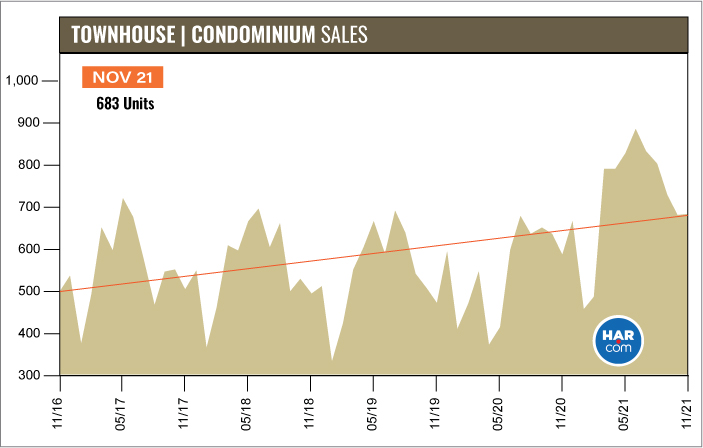

Townhouse/Condominium Update

Sales of townhouses and condominiums increased for the 15th consecutive month in November, rising 16.8 percent with 683 closed sales versus 585 a year earlier. The average price jumped 16.0 percent to $258,970 and the median price increased 10.5 percent to $210,000. Inventory fell from a 3.7-months supply to 2.1 months.

Houston Real Estate Highlights in November

- Single-family home sales rebounded from a slight decline in October, rising 3.9

percent with 8,320 units sold versus 8,010 in October 2020; - Days on Market (DOM) for single-family homes dropped from 46 to 35;

- Total property sales rose 5.6 percent with 10,216 units sold;

- Total dollar volume increased 20.6 percent to $3.7 billion;

- The single-family average price rose 12.6 percent to $383,807;

- The single-family median price increased 16.3 percent to $314,000 – an all-time high first reached in June of 2021;

- Single-family home months of inventory registered a 1.6-months supply, down from 2.1 months year-over-year and below the national inventory of 2.4 months;

- On a year-to-date basis, single-family homes sales are 12.0 percent ahead of 2020’s record pace and 22.2 percent ahead of 2019.

- Townhome/condominium sales rose 16.8 percent with the average price up 16.0 percent to $258,970 and the median price up 10.5 percent to $210,000;

- Single-family home rentals rose 7.1 percent with the average rent up 8.5 percent to $2,042;

- Townhome/condominium leases increased 5.1 percent with the average rent up 3.8 percent to $1,737.