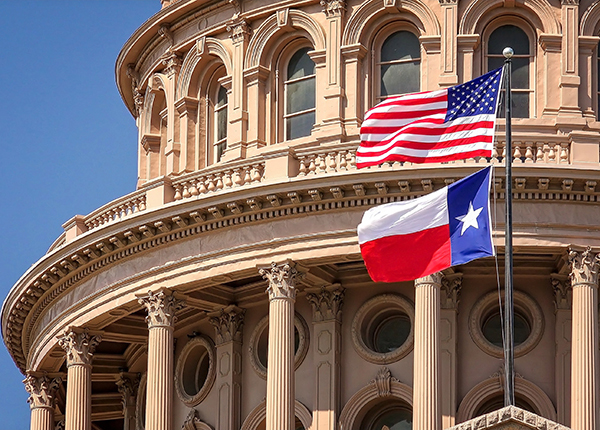

Last month, we walked you through how the Texas House of Representatives works, what it rules on and how it affects your business. This month, we will be discussing the Texas State Senate. Texas’s legislative branch, along with most other states, operates in a bicameral system meaning there are two chambers called the House of Representatives and the Senate. This system is very similar to that used by the United States federal government, which we will be discussing later this year.

The Texas State Senate is made up of 31 members each of whom serve more than 500,000 constituents. While State Representatives serve two-year terms, members of the State Senate serve four-year terms. The House and the Senate meet for 140 days every two years for regular session. Special sessions can be called by the Governor if necessary. Like the members of the house, state senators make a salary of only $7,200 per year plus an additional $190 for every day Legislature in session. Due to the small salary, most members of the state legislature have additional occupations outside of serving in the house or senate.

The presiding officer over the Senate is the Lieutenant Governor who is elected by voters statewide. This is a small differentiator from the United States Senate where the presiding officer over the Senate is the Vice President. The Lieutenant Governor serves four year terms and serves as the Chairman of the Legislative Budget Board and the Legislative Council. When serving as presiding officer of the senate, the salary of the Lieutenant Governor is the same as the members of the senate. Another role of the Lieutenant Governor is to serve as Governor when the Governor is unable to do so. The current Lieutenant Governor of Texas is Dan Patrick.

In the Texas State Senate, there are a number of committees that rule on issues that affect real estate. Some of these committees include Business & Commerce,Transportation, Property Tax and Water & Rural Affairs. The Property Tax Committee in the Texas Senate is likely the most important committee in the entire legislature to REALTORS® and their business. Currently, the Property Tax Committee includes former HAR Recommended Candidates Sen. Paul Bettencourt, who is the chair, and Sen. Brandon Creighton. Last legislative session Sen. Bettencourt authored Senate Bill 2, also known as the Texas Property Tax Reform and Transparency Act. This bill made changes to the rollback rate and implemented numerous pro-REALTOR® measures that increased transparency for taxpayers. This is a great example of the HAR political affairs process. First, HAR supported Sen. Bettencourt in his reelection campaign in 2018, and one year later, he authored a bill that made substantial changes for HAR members and REALTORS® across the state.

Be sure to check back next month as we discuss the roles of the Governor of Texas.