Single-family home sales achieve the biggest increase of 2019

Lower mortgage interest rates, improving oil prices, steady economic growth and a more plentiful supply of housing translated to a strong month for home sales throughout greater Houston in April. Luxury homes (priced at $750,000 and above) drew the greatest volume of sales followed closely by homes in the $150,000 to $250,000 range. Housing inventory grew to its highest level since last September, keeping up with consumer demand midway through the spring buying season.

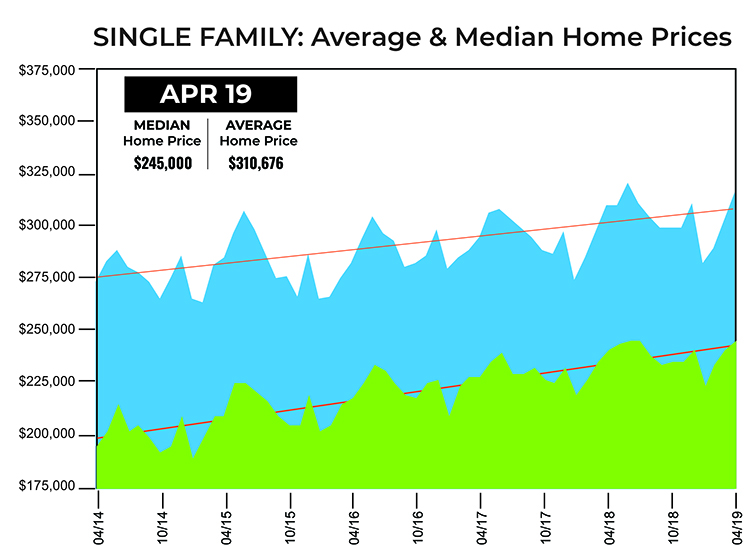

According to the latest monthly report from the Houston Association of REALTORS® (HAR), sales of single-family homes increased 7.8 percent in April, with 7,586 homes sold compared to 7,035 in April 2018. That marks the third straight month of positive sales and the biggest volume gain of 2019. On a year-to-date basis, home sales are 2.2 percent ahead of last year’s record pace.

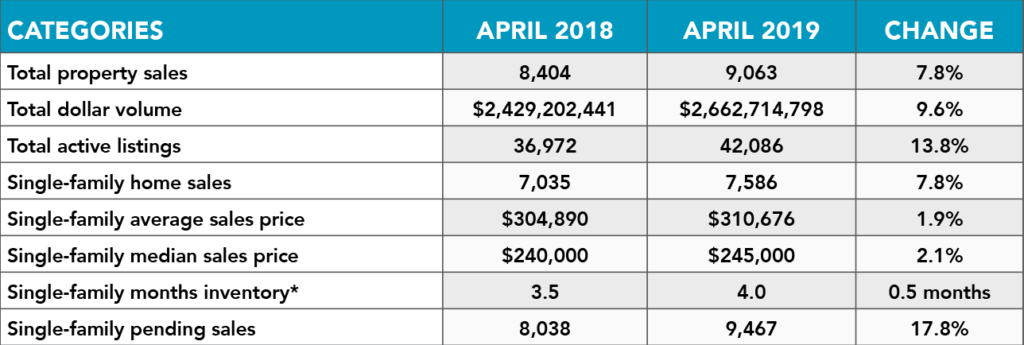

Single-family homes prices reached record highs for an April. The median price (the figure at which half of the homes sold for more and half sold for less) rose 2.1 percent to $245,000 and the average price was up 1.9 percent to $310,676 – the second highest average of all time.

April sales of all property types totaled 9,063, up 7.8 percent compared to the same month last year. Total dollar volume for the month jumped 9.6 percent to about $2.7 billion.

“Consumers have been taking advantage of optimal conditions for homebuying, with low interest rates and a growing supply of properties, and that has powered Houston to a strong springtime performance,” said HAR Chair Shannon Cobb Evans with Heritage Texas Properties. “The rental market also remains healthy, and we’re relieved to see sales finally turning around among townhomes and condominiums.”

Lease Property Update

April saw continued demand for single-family rentals, which jumped 12.7 percent compared to a year earlier. However, interest in townhome/condominium rentals waned, declining 4.4 percent. The average rent for a single-family home edged up less than one percent to $1,795 while the average rent for townhomes and condominiums also increased less than one percent to $1,586.

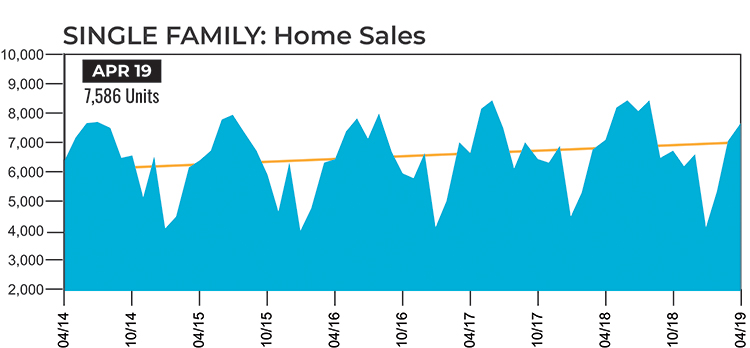

April Monthly Market Comparison

The measurements were all in positive territory for the Houston real estate market in April. Single-family home sales, total property sales, total dollar volume and pricing were all up compared to April 2018. Month-end pending sales of single-family homes totaled 9,467, a 17.8 percent increase over last year. Total active listings, or the total number of available properties, jumped 13.8 percent to 42,086.

Single-family homes inventory expanded to a 4.0-months supply in April. That is up from 3.5 months a year earlier and marks the greatest supply of homes since September 2018. For perspective, housing inventory across the U.S. is currently at a 3.9-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Single-family home sales rose 7.8 percent in March, with 7,586 units sold throughout the greater Houston area versus 7,035 a year earlier. That marks the third consecutive month of positive sales activity and the biggest volume gain of 2019.

Prices reached the highest levels ever for an April. The median price increased 2.1 percent to $245,000. The average price rose 1.9 percent to $310,676 – the second highest average of all time (the highest was $315,492 in June 2018).

Days on Market (DOM), or the number of days it took the average home to sell, edged up from 56 to 57 days. Inventory grew to a 4.0-months supply. That is up from 3.5 months a year earlier and represents the greatest supply of homes in seven months. It is also slightly above the national inventory of 3.9 months reported by NAR.

Broken out by housing segment, April sales performed as follows:

- $1 – $99,999: decreased 17.0 percent

- $100,000 – $149,999: decreased 14.6 percent

- $150,000 – $249,999: increased 12.5 percent

- $250,000 – $499,999: increased 9.4 percent

- $500,000 – $749,999: increased 6.9 percent

- $750,000 and above: increased 14.2 percent

HAR also monitors sales activity among existing single-family homes. Existing home sales totaled 6,138 in April, up 7.3 percent versus the same month last year. The average sales price edged up 1.1 percent to $300,195 while the median sales price rose a fractional 0.7 percent to $230,000.

Townhouse/Condominium Update

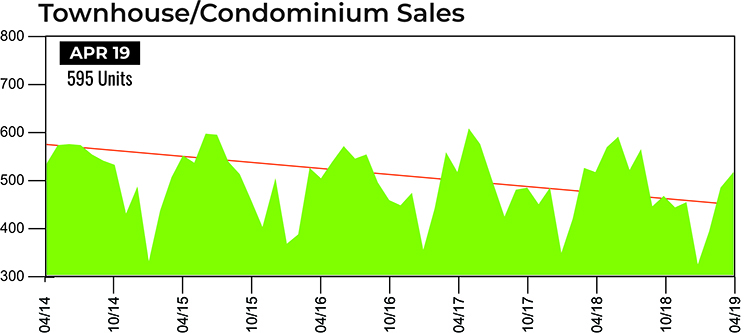

Townhouse and condominium sales were flat in April, finally bringing to an end seven consecutive months of declines. A total of 595 townhouses and condominiums sold, matching last April’s volume. The average price fell 8.4 percent to $203,751 while the median price dropped 9.0 percent to $163,000. Inventory grew from a 3.9-months supply to 4.5 months.

Houston Real Estate Highlights in April

- Single-family home sales rose 7.8 percent year-over-year, with 7,586 units sold, marking the third consecutive month of positive sales and the biggest volume increase of 2019;

- On a year-to-date basis, single-family home sales are 2.2 percent ahead of 2018’s record pace;

- Days on Market (DOM) for single-family homes edged up from 56 to 57 days;

- Total property sales increased 7.8 percent, with 9,063 units sold;

- Total dollar volume jumped 9.6 percent to about $2.7 billion;

- The single-family home median price rose 2.1 percent to $245,000, achieving an April high;

- The single-family home average price was up 1.9 percent to an April high of $310,676 – the second highest average of all time;

- Single-family homes months of inventory reached a 4.0-months supply, up from 3.5 months last April and the most plentiful level since September 2018. For comparison, the national inventory is at a 3.9-months supply, according to NAR;

- Townhome/condominium sales ended seven months of declines with a flat sales volume of 595 units, the average price down 8.4 percent to $203,751 and the median price down 9.0 percent to $163,000;

- Single-family home rentals surged 12.7 percent with the average rent up less than one percent to at $1,795;

- Volume of townhome/condominium leases declined 4.4 percent with the average rent up less than one percent to $1,586.