Homes priced between $150K and $500K performed best

The Houston real estate market managed to resist most of the effects of the energy downturn in February, with home sales up over two percent compared to the same month last year. Single-family homes priced between $150,000 and $500,000 recorded positive sales volume while the luxury home segment experienced the biggest decline.

According to the latest monthly report compiled by the Houston Association of REALTORS® (HAR), February single-family home sales rose 2.2 percent versus February 2015, with a total of 4,602 sales compared to 4,505 a year earlier. New listings helped inventory grow from a 2.7-months supply to 3.4 months.

“So far in 2016, the Houston housing market has remained healthy despite the ongoing strains facing the energy industry,” said HAR Chairman Mario Arriaga with First Group. “Sales are still down in the luxury home market, but, just as we saw in January, mid-range housing performed well and inventory levels grew. There was also a lot of activity among rental properties.”

Last week, the Greater Houston Partnership (GHP) reported revised Texas Workforce Commission data showing that the Houston metropolitan area gained 15,200 jobs in 2015, not the 23,200 jobs previously estimated. The GHP report also stated that nearly 51,000 jobs were lost in January, a 1.7 percent decline and slightly above what is considered average for that time of year.

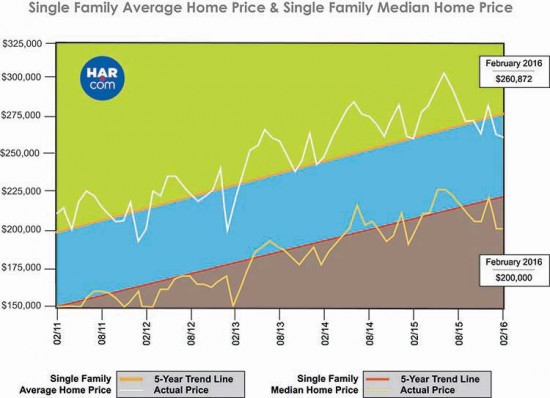

The single-family home average price squeezed out a fractional 0.5 percent year-over-year increase, reaching $260,872, the highest figure ever for a February. The median price—the figure at which half of the homes sold for more and half sold for less—was unchanged at $200,000.

February sales of all property types in Houston totaled 5,548, statistically flat compared to the same month last year. Total dollar volume for properties sold in February rose 1.2 percent to $1.4 billion.

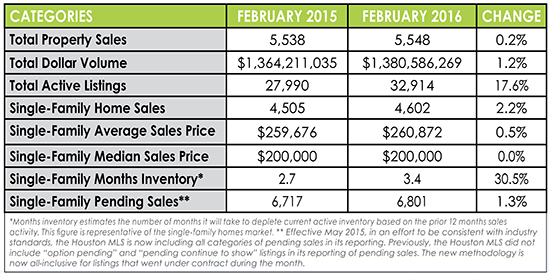

February Monthly Market Comparison

Houston’s monthly housing market measurements were largely positive in February compared to those from a year earlier. On a year-over-year basis, single-family homes sales, average price, total dollar volume and inventory levels rose while median sales price was flat.

Month-end pending sales for single-family homes totaled 6,801. That is up 1.3 percent compared to last year. Total active listings, or the total number of available properties, at the end of February rose 17.6 percent from February 2015 to 32,914.

An increase in new listings in February gave single-family homes inventory a boost, with levels climbing from a 2.7-months supply to 3.4 months. For perspective, the national supply of homes reported by the National Association of REALTORS® (NAR) currently stands at 4.0 months.

Single-Family Homes Update

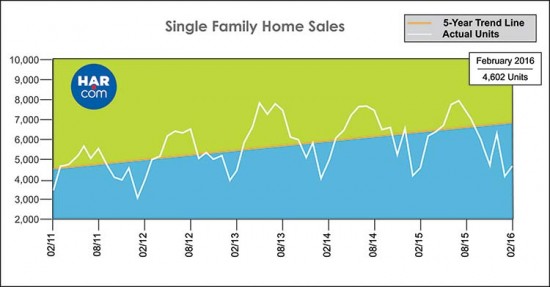

Single-family home sales totaled 4,602 in February, up 2.2 percent from February 2015. That marks the first increase in sales volume since last September.

The average price increased a fractional 0.5 percent to $260,872, a record high for a February in Houston, while the median price remained unchanged at $200,000. Days on Market (DOM), or the number of days it took the average home to sell, edged up to 62 days versus 61 in 2015.

Broken out by housing segment, February sales performed as follows:

- $1 – $79,999: decreased 1.1 percent

- $80,000 – $149,999: decreased 7.3 percent

- $150,000 – $249,999: increased 9.5 percent

- $250,000 – $499,999: increased 4.4 percent

- $500,000 and above: decreased 12.0 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 3,869 in February, up 4.6 percent versus the same month last year. The average sales price rose 1.0 percent year-over-year to $238,961 while the median sales price climbed 2.6 percent to $185,000.

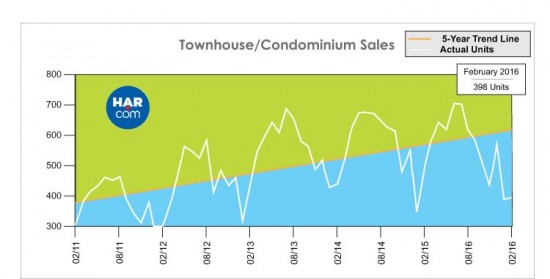

Townhouse/Condominium Update

Sales of townhouses and condominiums dropped 17.8 percent in February. A total of 398 units sold compared to 484 properties in February 2015. The average price declined 1.3 percent to $199,205 while the median price rose 2.8 percent to $150,000. Inventory grew from a 2.6-months supply to 3.3 months.

Lease Property Update

Demand for single-family lease homes shot up 14.6 percent in February while townhomes/condominiums saw demand increase 10.3 percent. The average rent for single-family homes edged up 0.6 percent to $1,688 while the average rent for townhomes/condominiums rose 2.5 percent to $1,545.

Houston Real Estate Highlights in February

- Single-family home sales rose 2.2 percent compared to last February, marking the first increase since September 2015;

- Total property sales were unchanged at 5,548 units;

- Total dollar volume increased 1.2 percent to $1.4 billion;

- At 260,872, the single-family home average price reached its highest level ever for a February;

- The single-family home median price was unchanged from a year earlier at $200,000;

- Single-family homes months of inventory climbed to a 3.4-months supply versus 2.7 months a year earlier;

- Townhomes/condominium sales fell 17.8 percent with the average price down 1.3 percent at $199,205 and the median price up 2.8 percent to $150,000;

- Leases of single-family homes soared 14.6 percent with rents up a fractional 0.6 percent at $1,688;

- Leases of townhomes/condominiums climbed 10.3 percent with rents up 2.5 percent to $1,545.