Sluggish December sales and limited housing supply can’t slow down overall real estate activity for the year

HOUSTON — (January 9, 2019) — The Houston real estate market set new records in 2018 despite uncertainty across the region when the year began, with many survivors of Hurricane Harvey still rebuilding their homes and lives. Single-family home sales for the full year surpassed 2017’s record volume by nearly four percent. However, as 2019 gets underway, housing inventory remains constrained – still sitting below its more balanced pre-Harvey levels.

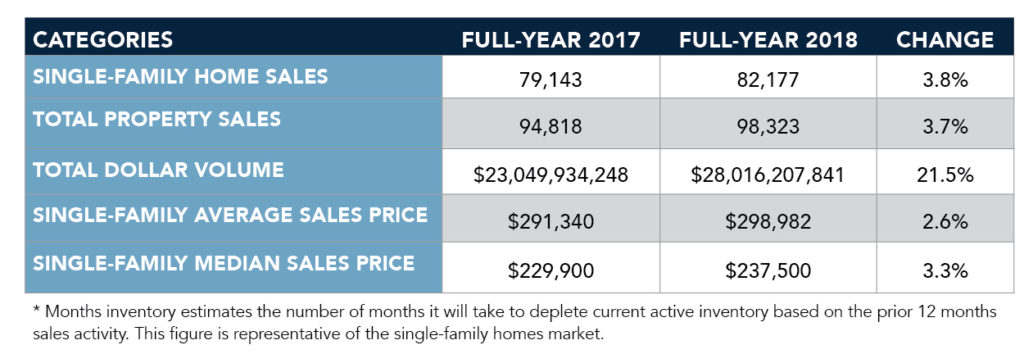

According to the Houston Association of Realtors’ (HAR) 2018 annual report, single family home sales rose 3.8 percent to 82,177 while sales of all property types totaled 98,323, a 3.7-percent increase over 2017’s record volume. Total dollar volume for full-year 2018 jumped 21.5 percent to a record-breaking $28 billion.

“We entered 2018 cautiously optimistic that the Houston real estate market would continue the resilience it showed after Hurricane Harvey, but no one that I know anticipated it being a record year,” said HAR Chair Shannon Cobb Evans with Heritage Texas Properties. “Now, as we look ahead to the new year, federal workers are on edge about the ongoing government shutdown and how that might hurt their cash flow, which could affect housing. And our market is still challenged in terms of housing inventory, which is something that truly needs to improve in 2019 to ensure that real estate remains a vibrant player in the overall Houston economy.

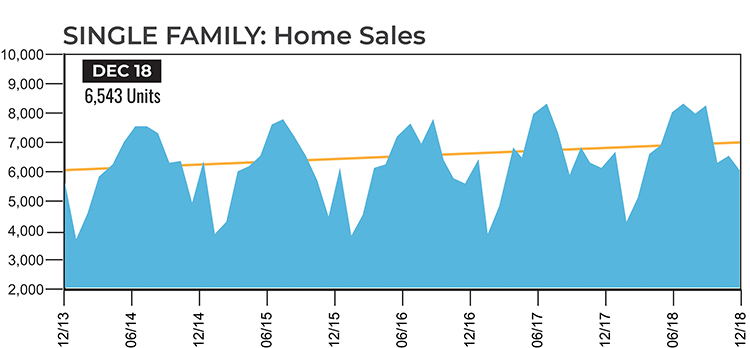

December single-family home sales fell 4.1 percent to 6,543 versus December 2017. Only two housing segments saw positive sales activity, with the strongest taking place in the luxury market – that is, homes priced from $750,000 and up. Total property sales for the month declined 4.6 percent to 7,709.

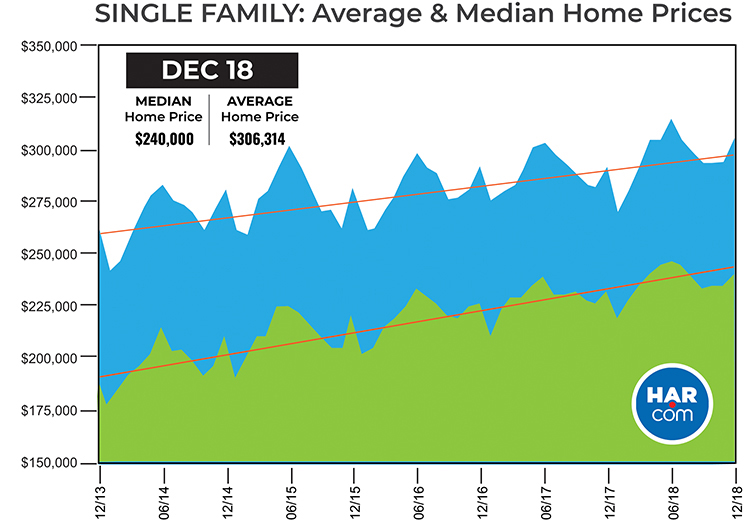

The single-family home median price (the figure at which half of the homes sold for more and half sold for less) rose 3.4 percent to $240,000. That marks the highest median price ever for a December. The average price increased 4.7 percent to $306,314, which is also an all-time December high.

2018 Annual Market Comparison

As 2018 began, Houston’s overall economic landscape showed a gradual return to normalcy, with many Harvey-battered properties coming back online or being demolished and rebuilt altogether, and the resumption of hiring in a variety of industry sectors. Throughout the year, those employment trends contributed to an influx of home buyers and renters to the Houston area from across the country and around the world.

When HAR issued its August and September home sales reports, the association cautioned that much of the data was distorted because it compared to the period in 2017 when Hurricane Harvey struck and effectively halted real estate activity for the last week or so of August. Once transactions resumed during the early to middle part of September, the volume was unusually high. This created an exaggerated sales increase for August 2018 and, conversely, an exaggerated decline for September 2018.

Housing inventory grew to its highest levels – between a 4.0- and 4.1-months supply – from June through September, but by year’s end, had retreated to a 3.5-months supply as consumers grabbed available properties. Months of inventory estimates the number of months it will take to deplete current active inventory based on the prior 12 months sales activity.

By the time the final December sales numbers were tallied, a record 82,177 single-family homes had sold during 2018. That represents an increase of 3.8 percent from the previous record of 79,143 in 2017.

On a year-to-date basis, the average price rose 2.6 percent to $298,982 while the median price increased 3.3 percent to $237,500. Total dollar volume for full-year 2018 surged 21.5 percent to a record-setting $28 billion.

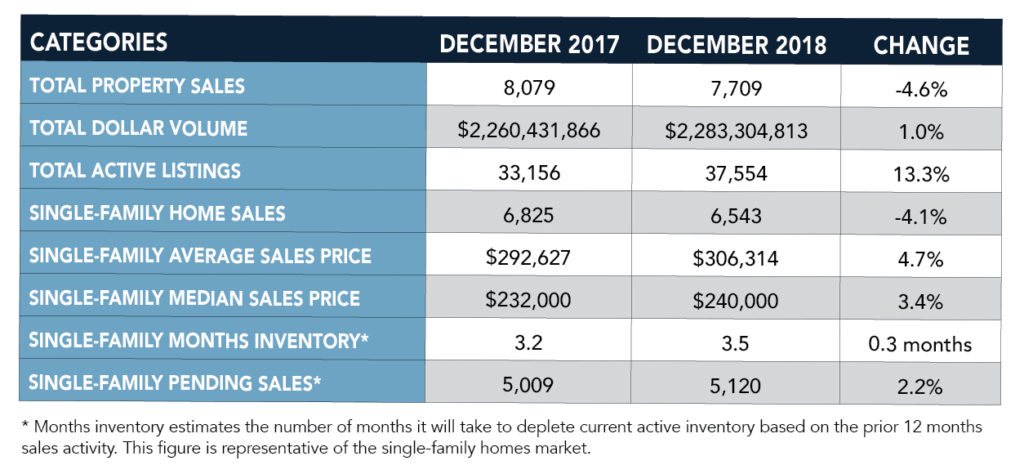

December Monthly Market Comparison

The Houston housing market generated mixed results in December, with single-family home sales and total property sales down, but total dollar volume and pricing all up compared to December 2017. Month-end pending sales for single-family homes totaled 5,120, an increase of 2.2 percent versus 2017. Total active listings, or the total number of available properties, jumped 13.3 percent from December 2017 to 37,554.

Single-family homes inventory grew slightly from a 3.2-months supply to 3.5 months. For perspective, housing inventory across the U.S. currently stands at a 3.9-months supply, according to the latest report from the National Association of Realtors (NAR).

December Single-Family Homes Update

Single-family home sales totaled 6,543, down 4.1 percent from December 2017. The median price rose 3.4 percent to a December high of $240,000. The average price increased 4.7 percent to $306,314. Days on Market (DOM), or the number of days it took the average home to sell, rose from 63 to 64.

Broken out by housing segment, December sales performed as follows:

- $1 – $99,999: decreased 31.0 percent

- $100,000 – $149,999: decreased 27.5 percent

- $150,000 – $249,999: decreased 1.9 percent

- $250,000 – $499,999: increased 1.4 percent

- $500,000 – $749,999: decreased 7.4 percent

- $750,000 and above: increased 20.0 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 4,975 in December, down 7.1 percent versus the same month last year. The average sales price rose 5.8 percent to $292,244 while the median sales price increased 3.8 percent to $220,000.

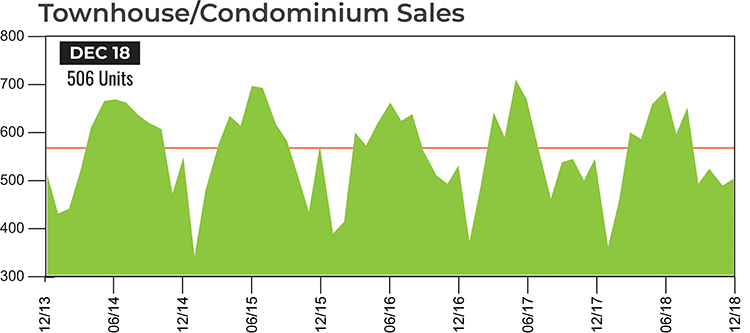

Townhouse/Condominium Update

Townhome and condominium sales also took a hit in December, falling 7.8 percent, with 506 units selling versus 549 a year earlier. The average price rose 4.6 percent to $206,760 and the median price jumped 8.1 percent to $169,500. Inventory grew from a 3.2-months supply to 3.8 months.

Lease Property Update

Houston’s lease market had a positive performance in December. Single-family home leases climbed 13.2 percent and townhome/condominium leases edged up 1.6 percent. The average rent for single-family homes was flat at $1,771 and the average rent for townhomes/condominiums was also flat at $1,532.

Houston Real Estate Highlights for December and Full-Year 2018

- Despite uncertainties amid Houston’s ongoing recovery from Hurricane Harvey, 2018 proved to be a record year for Houston home sales with 82,177 single-family homes sold versus 79,143 in 2017, the last record-setting year. That represents an increase of 3.8 percent

- Total dollar volume for full-year 2018 soared 21.5 percent to $28 billion;

- December single-family home sales declined 4.1 percent year-over-year with 6,543 units sold;

- Total December property sales fell 4.6 percent to 7,709 units;

- Total dollar volume for December edged up 1.0 percent to $2.3 billion;

- At $240,000, the single-family home median price rose 3.4 percent to a December high;

- The single-family home average price climbed 4.7 percent to a December high of $306,314;

- Single-family homes months of inventory grew slightly to a 3.5-months supply;

- Townhome/condominium sales fell 7.8 percent, with the average price up 4.6 percent to $206,760 and the median price up 8.1 percent to $169,500;

- Leases of single-family homes shot up 13.2 percent with average rent unchanged at $1,771;

- Leases of townhomes/condominiums edged up 1.6 percent with average also unchanged at $1,532.