By Patsy Fretwell

Rising demand for small land tracts in Texas and specifically in the Houston area during 2014 resulted in double-digit increases in sales, according to a new statewide report distributed by the Texas Association of Realtors.

“The explosive buyers’ rush for small land tracts that began in 2013 is on track to continue through 2015,” said the Texas Small Land Sales June 2015 report, which analyzes small land sales data and trends across seven regions of Texas from data provided by the Real Estate Center at Texas A&M University. Due to the significant physical variations among each region, the definition of a small land tract varies from 30 to 160 acres.

Statewide, small land sales totaled 5,282 sales in 2014, a 20.69 percent increase compared to last year. Unchanged from 2013 was the median tract size of 20 acres. Statewide, the average price per acre for small land tracts increased 3.5 percent to $5,018 during the last 12 months.

Sales “skyrocketed” in the Houston area’s region “despite falling oil prices in the last quarter of 2014,” the report said. Houston is located in Region Five, which includes one of the largest Metropolitan Statistical Areas, Houston-The Woodlands-Sugar Land, in addition to College Station-Bryan, Victoria and Beaumont-Port Arthur. Small land sales in this region consist of land parcels 42 acres or smaller.

The majority of land sales in this region occurred around the Houston metro area and were purchased by “metro residents seeking a recreational property out of town.” Sales increased to 1,238 in 2014, a 34.16 percent increase from 2013, with the volume of sales representing almost 25 percent of all sales statewide. The median tract size in the local region was 18 acres in 2014, a 10 percent decrease from 2013.

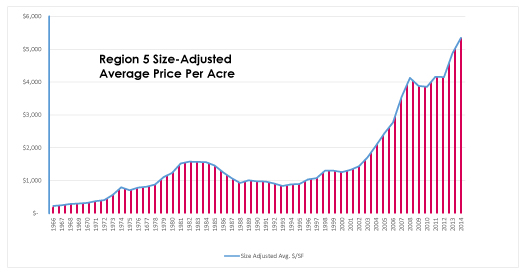

The Houston area’s average price per acre in 2014 was $9,167, representing the state’s highest price per acre and a slight decrease compared to the previous year. The report noted that to date, small land sales in the Houston region have not been affected by the downturn of the oil and gas industry, but the future remains unclear as to the long-term effects.

“Land sales in the first quarter looked pretty strong,” according to Dr. Charles Gilleland, the Real Estate Center’s research economist and land market specialist. “The market seemed to be holding up so far.” In a recent presentation on rural land prices, Gilleland said 2015 prospects had dimmed due to the uncertainty in the oil industry, but that Texas’ diversification would help what could be a challenging year.

Gilleland reported in his annual presentation a 9 percent increase in prices due to the strong 2014 demand for recreational properties and cropland. He noted that it took 38 years to top $1,000 per acre but only 9 years to top $2,000 per acre, with large tracts in the Gulf Coast area showing 10% increases.

To view the Texas Small Land Sales Report in its entirety, visit TexasRealEstate.com.