Robust supply fuels strong leasing activity

HOUSTON — (February 21, 2024) — The new year started with solid demand for single-family rental homes as well as townhomes and condominiums. Many would-be homebuyers are turning to Houston’s rental market due to ongoing concerns about elevated mortgage rates.

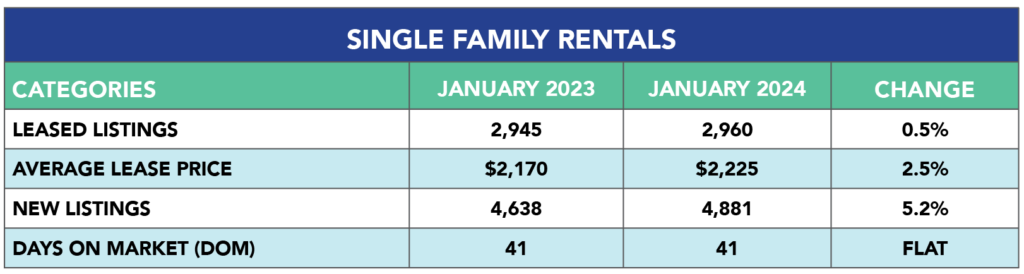

According to the Houston Association of Realtors®’ January 2024 Rental Market Update, single-family home rentals were up fractionally year-over-year, with the average rent up 2.5 percent to $2,225. A total of 2,960 leases were signed versus 2,945 in January 2023. New listings of single-family rentals rose 5.2 percent, adding to a robust supply of units. Days on Market, or the actual time it took to lease a home, was flat at 41 days.

“We are seeing a steady demand in Houston’s rental market as some prospective homebuyers are still choosing to hold off on making a move until mortgage rates come down,” said HAR Chair Thomas Mouton with Century 21 Exclusive. “For now, there appears to be an adequate supply of rental properties throughout the Houston area.”

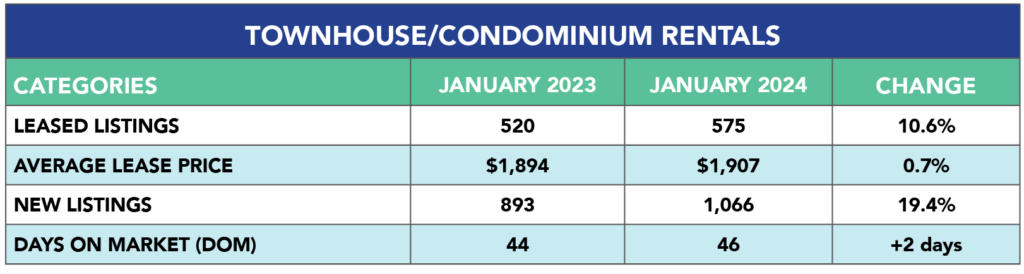

Consumers showed more interest in townhomes and condominiums for rent in January. Leases of those properties increased 10.6 percent on the year, with 575 units leased compared to 520 last January. Rents rose a fractional 0.7 percent to $1,907. New listings were up 19.4 percent. Days on Market increased from 44 to 46 days.

HAR’s new Rental Market Update is distributed the third Wednesday of each month, one week after the release of the monthly Sales Market Update. An archive of all these reports is available in the HAR Online Newsroom.