The Greater Houston rental market saw renters actively pursue single-family homes in February, even as mortgage rates eased.

According to the Houston Association of Realtors’ (HAR) February 2025 Rental Market Update, leased listings were 7.7 percent higher than they were during the same time last year. There were a total of 3,667 leases signed for single-family home rentals compared to 3,403 last February. The average lease price edged up by 1.4 percent to $2,246.

There continue to be more options for renters as new listings jumped 8.3 percent in February. A total of 5,287 single-family rental properties were added to the Multiple Listing Service (MLS). Days on Market, or the actual number of days it took to lease a home, increased from 41 to 44 days.

“Economic uncertainties are leading some cautious consumers to rent instead of buy a home at this time,” said HAR Chair Shae Cottar with LPT Realty. “While there’s been a modest increase in the lease price, the market remains competitive. Houston’s relatively affordable rental rates compared to other major cities make it an attractive option for many people looking to rent.”

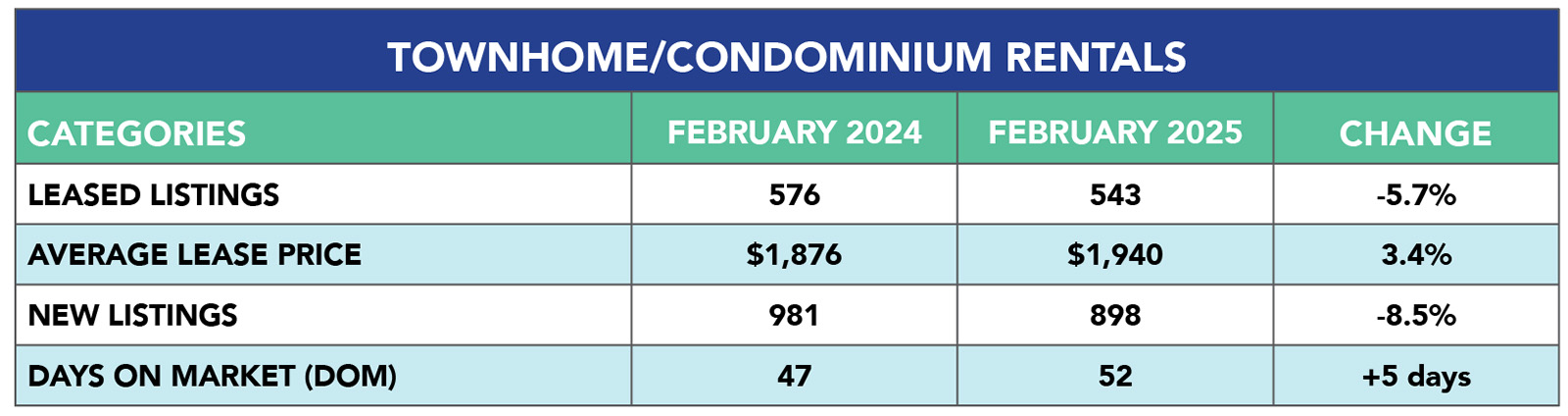

Leasing activity in the townhome and condominium market slowed for the fourth month in a row. In February, leased listings declined 5.7 percent year-over-year, with 543 units versus 576 last year. The average lease price increased 3.4 percent to $1,940.

The number of new listings for townhomes and condos fell 8.5 percent to 898 units compared to 981 last February. The average time it took to lease one of these properties increased to 52 days from 47 days last year.

HAR’s Rental Market Update is distributed the third Wednesday of each month, one week after the release of the monthly Sales Market Update. An archive of all HAR housing reports is available in the HAR Online Newsroom.

Screenshot

Screenshot