The massive office sublease market continues to dominate when discussing Houston’s commercial office market. A recent Houston Business Journal-sponsored panel of veteran commercial brokers highlighted in detail the many energy firms cutting back on office space as they downsized their workforce.

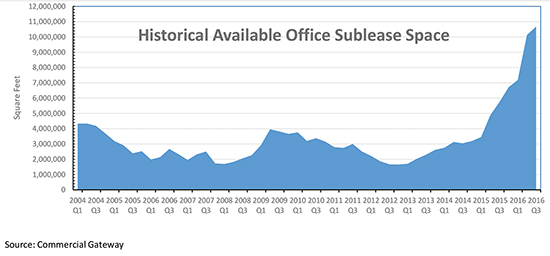

The current sublease market creates national headlines because there has never been so much sublease square footage available in the history of the city. Commercial Gateway has tracked office space since 2003, and the sublease availability has fluctuated throughout the economic downturns. The current total of almost 11 million square feet is more than triple the historical average of 3.3 million square feet per quarter. Prior to 2014, that historical quarterly average was only 2.8 million square feet. The current total sublease space represents 27% of all Class A and B space marketed as available in the Houston market.

Sublease space continues to be added to the market although limited leasing activity keeps the totals from rising too much higher. The most recent 600,000 square feet taken off the sublease rolls resulted from Conoco Phillips taking back their newly-built but empty Energy Center Four building; the company decided to finish out the space to relocate employees in mid-2018. Definite plans have not been released regarding their current space at 600 N. Dairy Ashford.

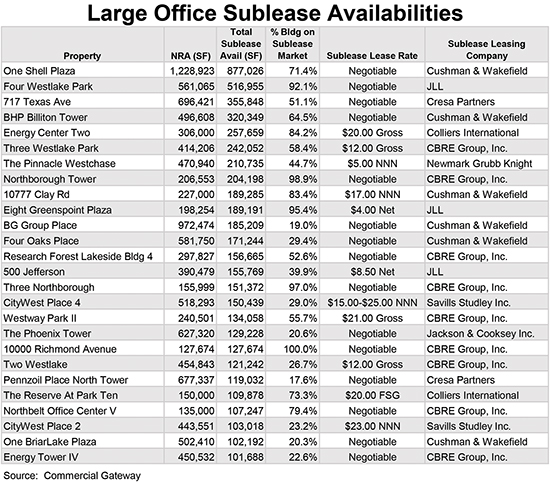

Currently 42 buildings are offering blocks of more than 50,000 square feet while 26 of those 42 can provide more than 100,000 square feet of contiguous space. One Shell Plaza in the Central Business District offers the largest block of space at 877,026 square feet. Shell Oil employees will be relocating from their namesake tower after 45 years of occupancy to company facilities in West Houston during the first quarter of 2017.

The largest sublease spaces are geographically concentrated in four submarkets: the Central Business District has 25.0% of the total available, the Energy Corridor offers 18.3%, Uptown is at 13.7% and the Westchase District is at 12.7%. Many of these larger blocks of space have purposely been kept large to save on build-out costs; most landlords prefer to wait and lease to full-floor tenants so many smaller deals have not been completed. Veteran office brokers anticipate more sublease space appearing throughout 2017 as energy firms continue to merge and downsize their office footprints. Efficiency has also played a role as many firms are reconfiguring space needs to fit their current workforce.

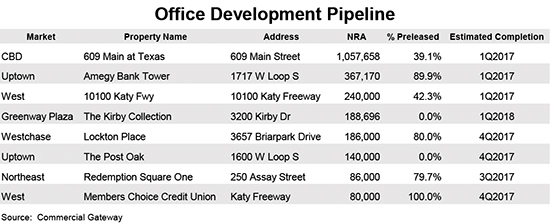

New space being completed can also potentially increase the sublease market, as firms move into their new space and add their old space to the market. The current under-construction total is at a low of 2.5 million square feet, and all space is collectively 50% preleased. The two largest buildings, the 1.1 million square-foot 609 Main at Texas in the Central Business District and Amegy Bank’s new headquarter’s building in Uptown of 367,170 square feet, will be completed in the first couple months of 2017; they will add quality space to the market and maybe sublease space as the companies who preleased space occupy their new space.

Leasing activity picked up in the latter part of 2016, but most brokers point to continued slow leasing activity and little new development throughout 2017. Tenants whose leases are expiring have many options, and most are moving up to better space for little or no increase in costs. More concessions are being introduced on direct space to compete with the sublease space offerings, and the office market recovery is predicted to be 18 to 36 months out.