Consumers maintained a steady demand for single-family rental homes

Mortgage rate volatility may have cooled home sales in April, but consumers maintained a steady demand for single-family rental homes which remain in plentiful supply. As in previous months, there was slightly less demand for townhomes and condominiums for rent.

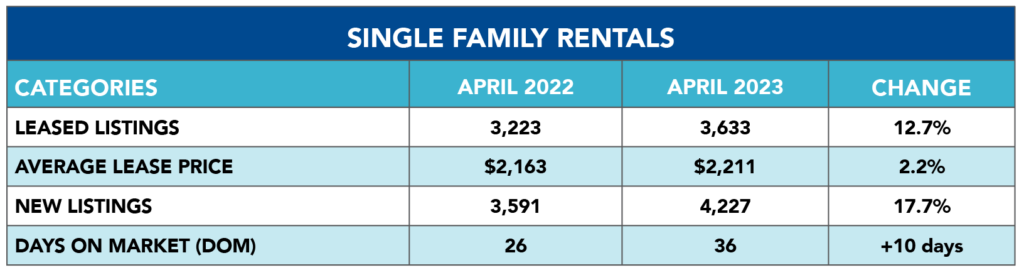

According to the Houston Association of REALTORS®’ (HAR’s) April 2023 Rental Market Update, single-family home rentals rose 12.7 percent year-over-year with the average lease price climbing 2.2 percent to $2,211. A total of 3,633 leases were signed versus 3,223 in April 2022.

New listings of single-family rentals rose 17.7 percent in April, providing an ample supply of homes to meet the ongoing demand. Days on Market, or the actual number of days it took to lease a home, rose from 26 to 36 days.

“As long as mortgage rates keep fluctuating and consumers remain concerned about inflation, Houston’s rental market will prosper,” said HAR Chair Cathy Treviño with Side, Inc. “Single-family rentals remain the brightest spot for housing right now, however we expect to see vitality return to the resale segment later this year.”

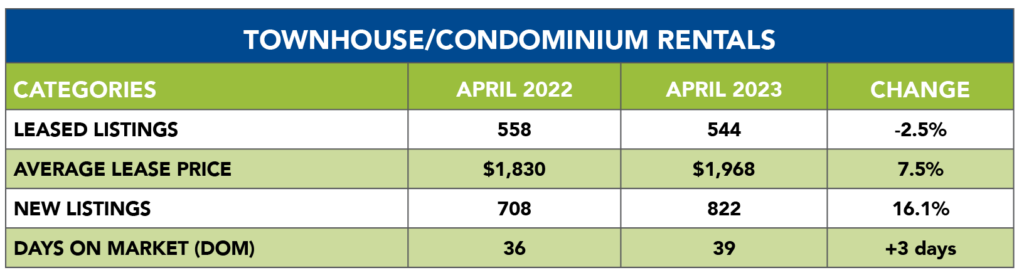

The townhome/condominium rental market was down slightly again in April. Leases of those properties fell 2.5 percent with 544 units leased compared to 558 last year. The average lease price rose 7.5 percent to $1,968. New listings jumped 16.1 percent and Days on Market went from 36 to 39 days.

Pre-pandemic Perspective: Compared to the last April before the pandemic, single-family home rentals are up 21.4 percent. In April 2019, leases were signed for 2,993 single-family homes. The average rent is currently 23.2 percent higher than it was back then – $1,795. Townhome/condominium rentals totaled 560 in April 2019. That is 2.8 percent ahead of the April 2023 volume. The average townhome/condo rent is currently 24.2 percent above its April 2019 price of $1,584.

HAR’s Rental Market Update is distributed on the third Wednesday of each month, one week after the release of the monthly Sales Market Update. An archive of all these reports is available in the HAR Online Newsroom.