The law of supply and demand is fully in play as a dwindling supply of homes sends prices to record highs; dollar volume jumps 46 percent

The great Houston home-grab continued in April as local property sales tore through the month at full-throttle. Buyer demand and an ever-shrinking supply drove home prices to the highest levels of all time.

According to the latest monthly report prepared by the Houston Association of REALTORS® (HAR), home sales surged 27.2 percent compared to last April, accounting for the 23rd consecutive month of positive sales. Housing inventory, which reached a 13-year low of 3.6 months during the first two months of the year and dipped to 3.5 months in March, dwindled even further in April to 3.4 months.

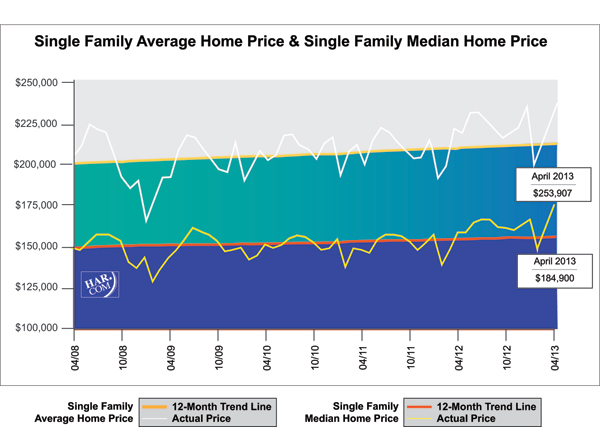

This pattern illustrates a classic tale of supply and demand, as the median price of a single-family home—the figure at which half the homes sold for more and half for less—shot up 14.5 percent to $184,900. The average price jumped 14.0 percent year-over-year to $253,907. Both represent record high prices for the Bayou City.

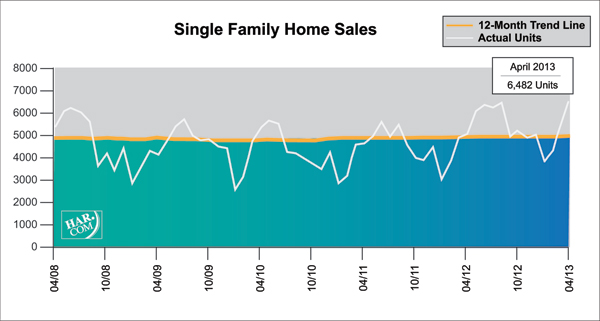

Contracts closed on 6,482 single-family homes. That is the largest one-month sales volume recorded since August 2007, right before the recession took hold. All housing segments experienced gains except for those priced under $80,000. Homes selling between $80,000 and $250,000 registered the greatest increase in sales volume.

“The Houston housing market shows absolutely no sign of letting up,” said HAR Chairman Danny Frank with Prudential Anderson Properties. “More homes listed for sale and a pick-up in new home construction are necessary to meet the growing demand of buyers. If anyone is considering selling their home, this is the time to consult a REALTOR® and start the process.”

The record pace of home sales is the direct result of robust economic conditions led by further growth in hiring, with the Texas Workforce Commission reporting more than 111,000 jobs created in Houston over the past year, as well as continued low interest rates.

Foreclosure property sales reported in the HAR Multiple Listing Service (MLS) declined 30.5 percent compared to April 2012. Foreclosures currently make up 10.4 percent of all property sales, down from 12.3 percent one month earlier and 19.6 percent at the beginning of the year. The median price of foreclosures climbed 4.5 percent to $83,500.

April sales of all property types in Houston totaled 7,883, a 28.8 percent increase over the same month last year. Total dollar volume for properties sold rocketed 45.9 percent to $1.9 billion versus $1.3 billion a year earlier.

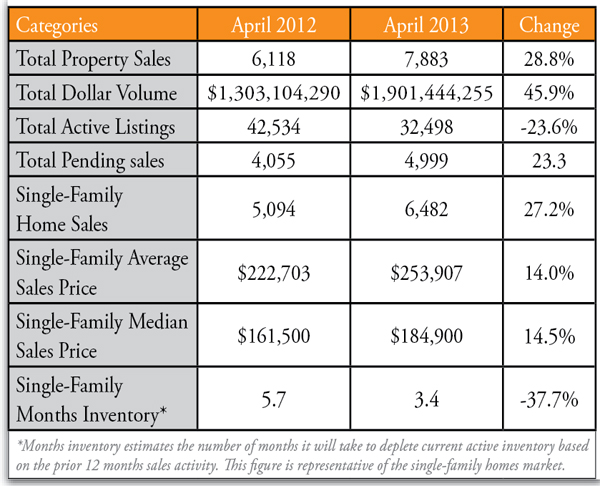

April Monthly Market Comparison

April brought positive results across the board for the Houston’s real estate market when all sales categories are compared to April 2012. On a year-over-year basis, total property sales, total dollar volume and average and median pricing all rose.

Month-end pending sales totaled 4,999. That is up 23.3 percent from last year and signals the likelihood of more positive sales news when the May figures are tabulated. Active listings, or the number of available properties, at the end of April declined 23.6 percent from April 2012 to 32,498.

After holding at 3.6 months in January and February before slipping slightly in March to 3.5 months, housing inventory declined a bit further in April to 3.4 months. Those levels are comparable to figures last seen here in 1999. The inventory of single-family homes across the United States stands at 4.7 months, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

April sales of single-family homes in Houston totaled 6,482, up 27.2 percent from April 2012. That marks the 23rd consecutive monthly increase as well as the largest one-month sales volume recorded since August 2007, just prior to the recession.

Home prices reached historic highs during the month. The single-family median price rose 14.5 percent from last year to $184,900 and the average price climbed 14.0 percent year-over-year to $253,907.

Broken out by housing segment, April sales performed as follows:

- $1 – $79,999: decreased 16.5 percent

- $80,000 – $149,999: increased 14.1 percent

- $150,000 – $249,999: increased 36.0 percent

- $250,000 – $499,999: increased 49.5 percent

- $500,000 – $1 million and above: increased 68.3 percent

HAR also breaks out the sales performance of existing single-family homes throughout the Houston market. In April 2013, existing home sales totaled 5,635, a 33.1 percent increase from the same month last year. The average sales price rose 15.6 percent year-over-year to $242,566 while the median sales price jumped 14.0 percent to $169,900.

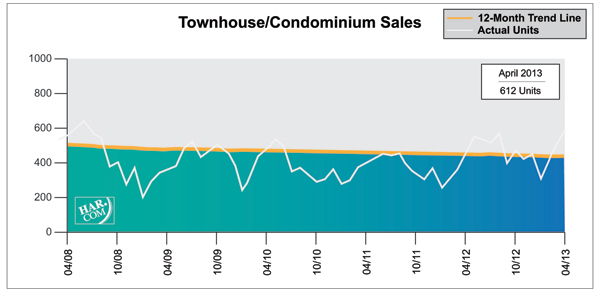

Townhouse/Condominium Update

April sales of townhouses and condominiums surged 31.0 percent from one year earlier. A total of 612 units sold last month compared to 467 properties in April 2012. The average price climbed 13.3 percent to $191,815 while the median price increased 2.2 percent to $139,000. Months inventory was 3.6 months versus the 6.8 months level it held in April 2012.

Lease Property Update

Houston’s lease property market heated up again in April. Rentals of single-family homes increased 20.6 percent compared to April 2012 and year-over-year townhouse/condominium rentals rose 15.8 percent. At $1,605, the average rent for single-family lease homes reached the highest price since last August. The average rent for townhouses/condominiums reached its highest price since last June at $1,404.

Houston Real Estate Milestones in April

- Single-family home sales increased 27.2 percent year-over-year, accounting for the market’s 23rd consecutive monthly increase and the largest one-month sales volume since August 2007;

- Total property sales rose 28.8 percent compared to one year earlier and also accounted for the largest one-month sales volume since August 2007;

- Total dollar volume surged 45.9 percent, increasing from $1.3 billion to $1.9 billion on a year-over-year basis;

- At $184,900, the single-family home median price reached an historic high for Houston;

- At $253,907, the single-family home average price also reached the all-time highest level;

- 3.4 months inventory of single-family homes is the lowest level since 1999 and compares to the national average of 4.7 months;

- Sales of townhouses/condominiums shot up 31.0 percent year-over-year.