Consumers clamor to lease homes while prices and interest rates keep for-sale homes out of reach for many

With interest rates soaring past 6 percent for a 30-year fixed-rate mortgage and home prices in record territory, would-be homebuyers continued to flock to rental homes in September.

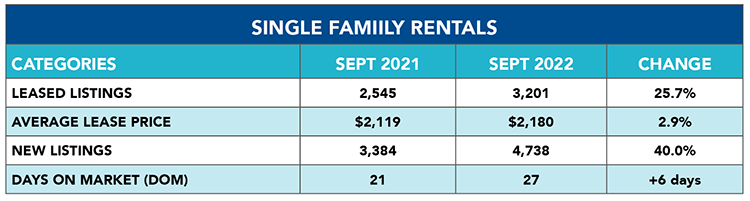

According to the Houston Association of REALTOR®’ September 2022 Rental Market Update, single-family home rentals shot up 25.7 percent year-over-year, with the average lease price up 2.9 percent to $2,180. A total of 3,201 leases were signed compared to 2,545 in September 2021.

New listings of single-family rentals surged 40 percent, paving the way for a broader selection of housing for consumers. Days on Market, or the actual number of days it took to lease a home, rose from 21 days to 27.

“Rental homes remain a cost-effective option for consumers who are having a hard time navigating the waters of a home purchase right now, between escalating prices and interest rates,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene. “We’ve seen steady interest in single-family leases, but in September, townhome and condo leases started taking off as well.”

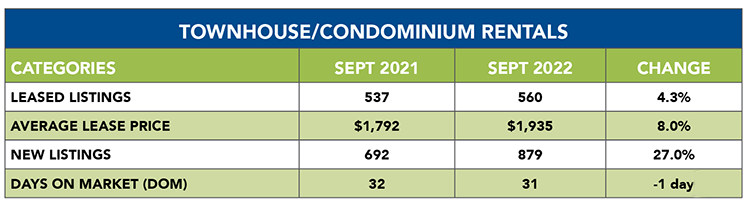

After a quiet couple of months, townhome and condominium rentals saw a pickup in consumer activity in September. Leases of those properties rose 4.3 percent, with 560 units leased compared to 537 last September. The average lease price rose 8.0 percent to $1,935, which is below the record high of $1,951 reached in May of 2022. New listings were up 27 percent. Days on Market went from 32 to 31 days.

HAR’s Rental Market Update is distributed on the third Wednesday of each month, one week after the release of the monthly Sales Market Update. An archive of all these reports is available in the HAR Online Newsroom.