For rental housing, 2023 began in much the same way that 2022 ended: with consumers keeping the single-family segment of the rental housing market buzzing. Economic uncertainty, including elevated interest rates and a lack of affordable housing, has been driving would-be buyers to rental properties since the middle of last year.

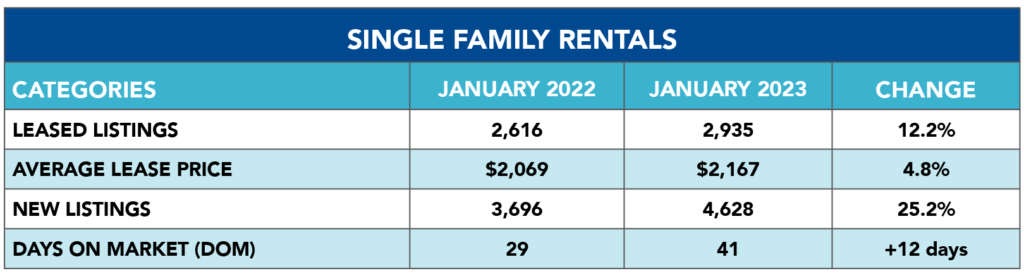

According to the Houston Association of Realtors’ January 2023 Rental Market Update, single-family home rentals rose 12.2 percent year-over-year, with the average lease price up 4.8 percent to $2,167. A total of 2,935 leases were signed versus 2,616 in January 2022.

New listings of single-family rentals surged 25.2 percent in January, ensuring that supply can meet the growing demand. Days on Market, or the actual number of days it took to lease a home, rose from 29 days to 41.

“Rental housing remains a hot commodity throughout the Houston market right now and that will continue until consumers start seeing tangible signs that economic pressures are easing,” said HAR Chair Cathy Treviño with Side, Inc. “There is an ample supply of rental homes out there and these properties give would-be homebuyers the look and feel of homeownership until conditions are suitable for them to consider buying again.”

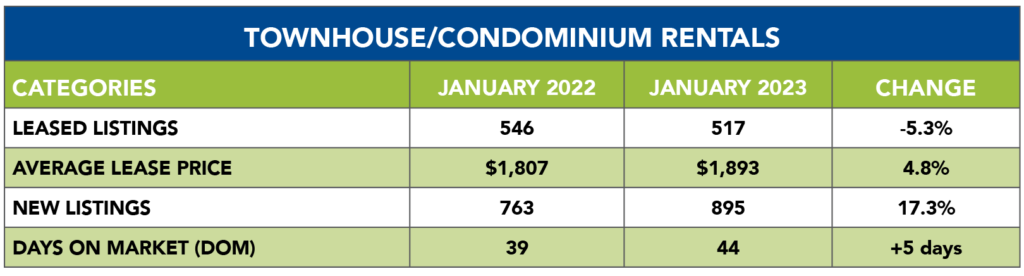

The townhome and condominium rentals market was down slightly in January. Leases of those properties fell 5.3 percent with 517 units leased compared to 546 last year. The average lease price rose 4.8 percent to $1,893. New listings shot up 17.3 percent and Days on Market climbed from 39 to 44 days.

HAR’s Rental Market Update is distributed on the third Wednesday of each month, one week after the release of the monthly Sales Market Update. An archive of all these reports is available in the HAR Online Newsroom.