Sales fall by the smallest amount since May of 2022; prices stabilize and inventory improves

Houston real estate appeared to be on approach for its own “soft landing” in August, as declining sales slowed to the lowest rate in more than a year. Despite another month of some negative indicators, the local housing market continues to demonstrate signs of a return to more seasonal trends, even as consumers maintain a wary eye on elevated interest rates and home prices.

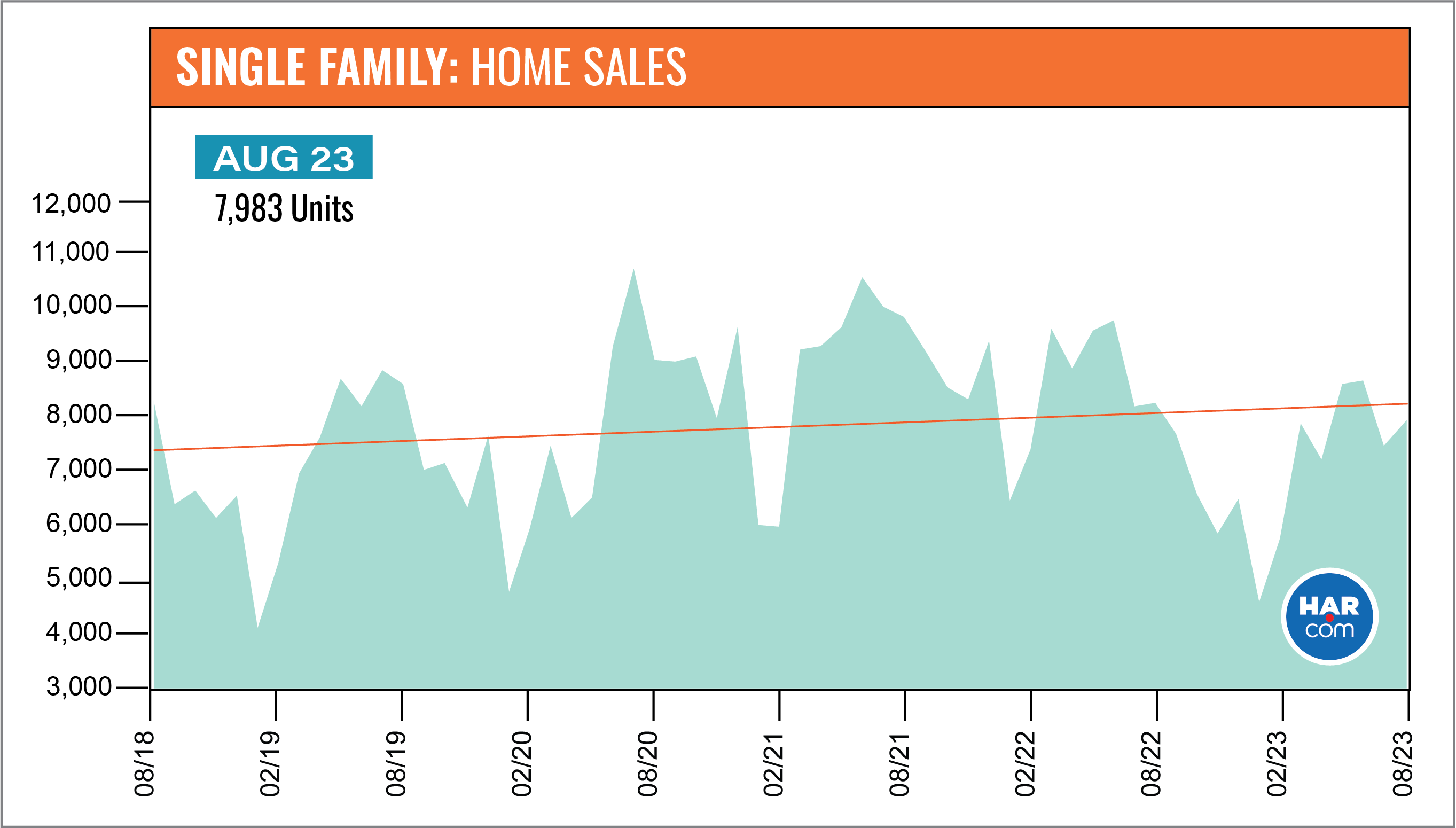

Home sales across Greater Houston were down for a 17th straight month in August, however the rate of decline was the smallest since last spring. According to the Houston Association of Realtors’ (HAR) August 2023 Market Update, single-family home sales fell 3.8 percent year-over-year with 7,983 units sold compared to 8,301 in August 2022. That is the lowest decline since sales dropped 0.8 percent in May 2022. Months supply of homes climbed to 3.3, the highest level since May 2020 when it also was 3.3. Compared to pre-pandemic August 2019, home sales were down 8.0 percent.

The luxury housing segment – comprised of homes priced at $1 million and above, which represents just 3.7 percent of all homes on the market – was the only segment with a gain. Rentals of single-family homes and townhomes/condominiums remain strong. HAR will publish its August 2023 Rental Home Update next Wednesday, September 20.

“While some of the August numbers for the Houston housing market were in negative territory, they are part of a gradual return to normalcy from pandemic-era trends that were unsustainable,” said HAR Chair Cathy Treviño with LPT, Realty. “We are working our way back to a better place with resale housing while continuing to see strong activity in the rental market.”

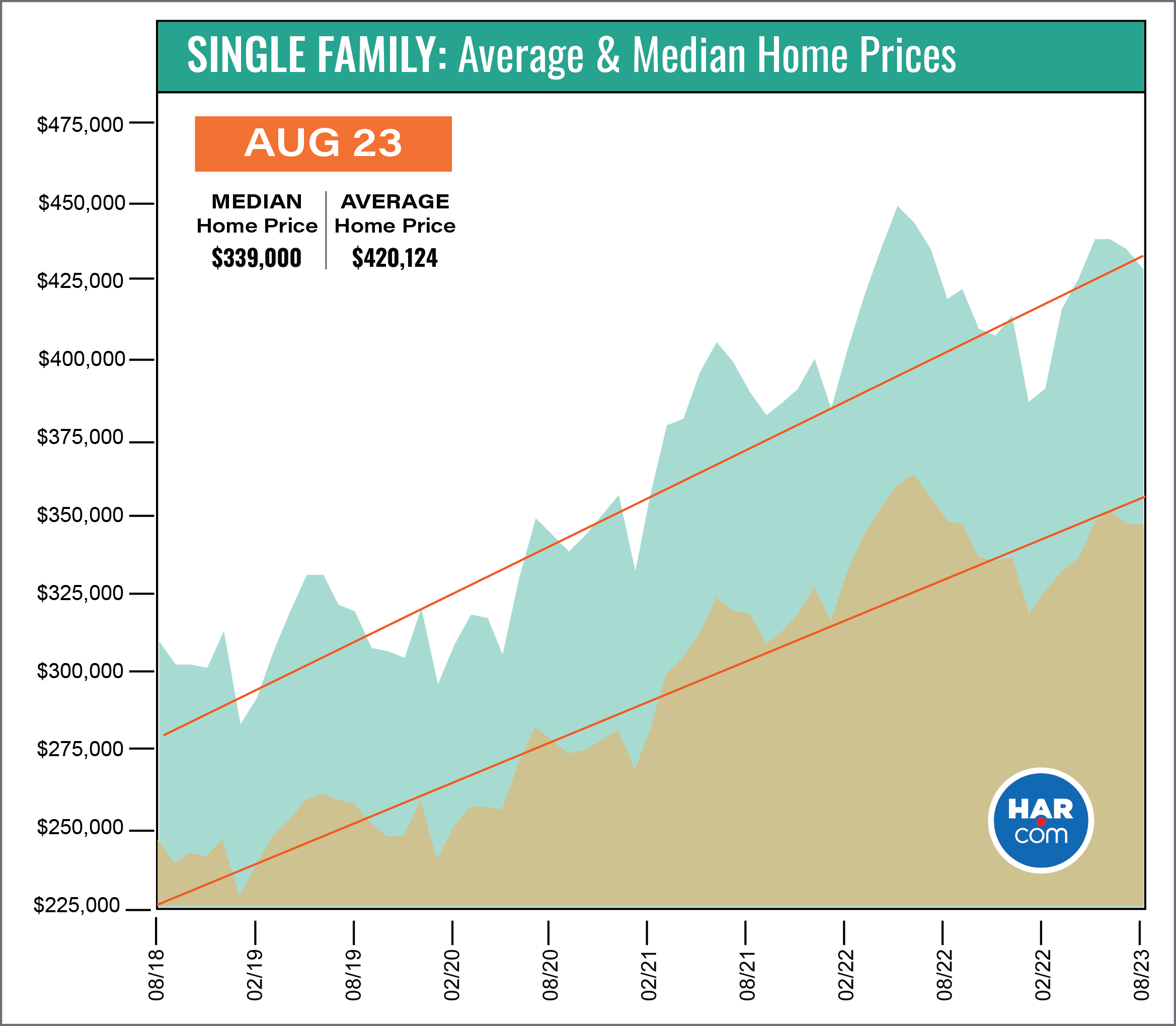

Single-family home prices continue to stabilize. The average price edged up just 2.5 percent to $420,124 while the median price was statistically flat at $339,000. Those figures are well below the record highs of $438,350 (average) in May 2022 and $354,000 (median) in June 2022.

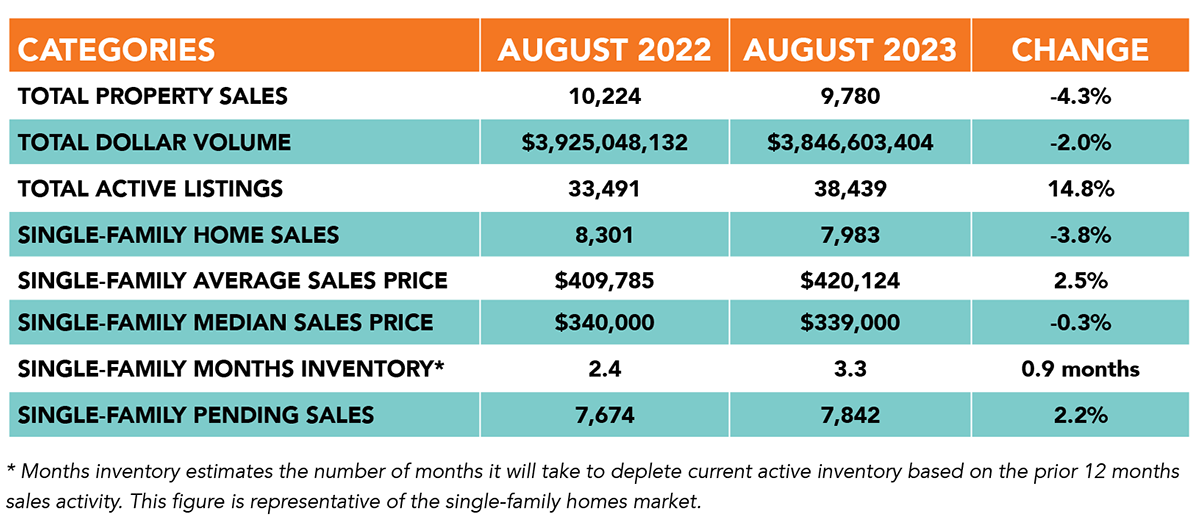

August Monthly Market Comparison

August was the 17th straight month of negative sales as Houston returns to the seasonal trending that prevailed before the pandemic. Year-over-year single-family home sales fell 3.8 percent, but when compared to pre-pandemic August 2019, sales were down 8.0 percent, and compared to August 2018, five years back, they were down 4.5 percent. The 3.8 percent decline is the smallest since the market registered a 0.8 percent drop in May 2022.

In addition to the decline in single-family sales volume, total property sales and total dollar volume also fell below last year’s levels. Total dollar volume was $3.8 billion, down from $3.9 billion a year earlier. Single-family pending sales rose 2.2 percent. Active listings, or the total number of available properties, were 14.8 percent ahead of the 2022 level.

Months of inventory expanded in August to a 3.3-months supply. That is the greatest months supply since May 2020 when it also was 3.3 months. Housing inventory nationally also sits at a 3.3-months supply, according to the latest report from the National Association of Realtors (NAR). A 4.0- to 6.0-months supply has traditionally been considered a “balanced market” in which neither buyer nor seller has the upper hand.

August Single-Family Homes Update

Single-family home sales fell 3.8 percent year-over-year in August with 7,983 units sold across the Greater Houston area compared to 8,301 in 2022. Pricing continues to settle after soaring to record highs last spring. The August average price rose 2.5 percent to $420,124 while the median price was statistically flat at $339,000.

For a pre-pandemic perspective, August closings were 8.0 percent below August 2019’s total of 8,673. The August 2023 median price of $339,000 is 35.6 percent higher than it was in 2019 ($249,975) and today’s average price of $420,124 is 35.5 percent higher than it was then ($310,139). Sales are 4.5 percent below where they were five years ago, in August 2018, when volume totaled 8,355. Back then, the median price was $238,200 and the average price was $300,169.

Days on Market, or the actual time it took to sell a home, increased from 32 to 42 days. Months of inventory registered a 3.3-months supply compared to 2.4 months a year earlier. The current national supply also stands at 3.3 months, as reported by NAR.

Broken out by housing segment, August sales performed as follows:

- $1 – $99,999: decreased 1.1 percent

- $100,000 – $149,999: decreased 8.5 percent

- $150,000 – $249,999: decreased 1.1 percent

- $250,000 – $499,999: decreased 4.7 percent

- $500,000 – $999,999: decreased 3.4 percent

- $1M and above: increased 21.3 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 6,207 in August, down 7.0 percent from the same month last year. The average price rose 2.9 percent to $418,321 and the median sales price was statistically flat at $331,500.

For HAR’s Monthly Activity Snapshot (MAS) of the August 2023 trends, please click HERE to access a downloadable PDF file.

Townhouse/Condominium Update

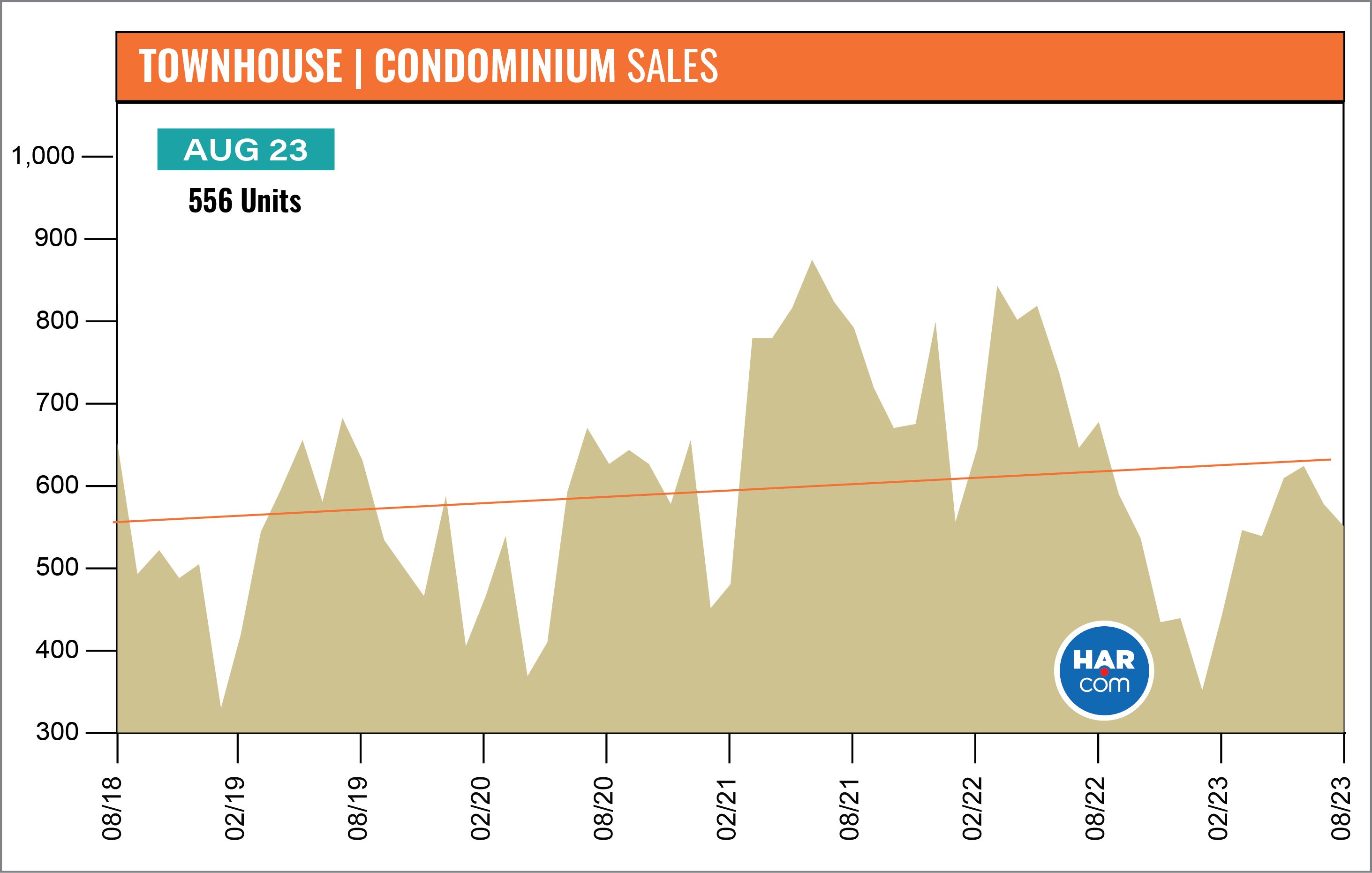

Townhouses and condominiums experienced their 15th consecutive monthly decline in August, falling 19.0 percent year-over-year with 556 closed sales versus 687 a year earlier. The average price rose 2.7 percent to $260,909 and the median price climbed 3.2 percent to $225,000. Inventory grew from a 1.9-months supply to 3.2 months, the highest level since January 2021.

Compared to pre-pandemic August 2019, when 639 units sold, townhome and condominium sales were down 13.0 percent. The average price back then, at $207,467, was 20.5 percent lower and the median price, at $172,000 was 23.6 percent lower.

Houston Real Estate Highlights in August

- Single-family home sales were down 3.8 percent year-over-year, the 17th consecutive month of slowing sales volume, however there continued to be signs of overall improvement to the local housing market;

- The 3.8 percent decline is the smallest since the market registered a 0.8 percent drop in May 2022;

- Compared to August 2019, before the pandemic, sales were down 8.0 percent, and compared to August 2018, five years back, they were down 4.5 percent.

- Days on Market (DOM) for single-family homes rose from 32 to 42 days;

- Total property sales fell 4.3 percent with 9,780 units sold;

- Total dollar volume dropped 2.0 percent to $3.8 billion;

- The single-family median price was statistically unchanged at $339,000;

- The single-family average price rose 2.5 percent to $420,124;

- Single-family home months of inventory registered a 3.3-months supply, up from 2.4 months a year earlier – the biggest supply in three years;

- Townhome/condominium sales experienced their 15h straight monthly decline, falling 19.0 percent, with the median price up 3.2 percent to $225,000 and the average price up 2.7 percent to $260,909;

- Compared to pre-pandemic 2019, townhome and condominium sales were down 13.0 percent.