All major market indicators rose in January, including sales volume and inventory

HOUSTON — (February 14, 2024) — Fresh on the heels of the holidays and despite lingering consumer concerns about elevated mortgage interest rates, the Houston real estate market achieved an unexpectedly strong start to 2024.

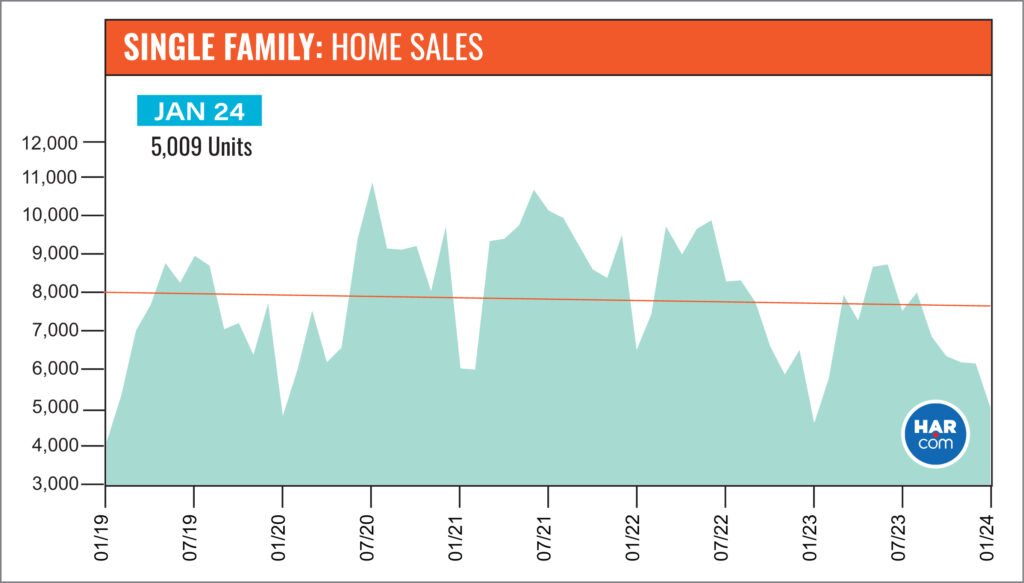

According to the Houston Association of Realtors®’ (HAR) January 2024 Market Update, single-family home sales across Greater Houston rose 9.0 percent. That is only the second increase in two years. The first was in November 2023 when sales were up 5.4 percent. The Houston Multiple Listing Service (MLS) recorded sales of 5,009 units compared to 4,595 in January 2023. Months supply of homes edged up from 2.6 to 3.3.

Only homes priced below $150,000 saw declines during the month, however that segment comprises just 1.5 percent of the overall market. The best performing segment consisted of homes priced between $500,000 and $1 million which jumped 16.7 percent year-over-year. That was followed by the luxury segment ($1 million +) which rose 15.4 percent. Next was the $250,000 to $500,000 segment which saw a 13.0 percent gain. Activity among lower- to mid-range homes — those priced between $100,000 and $250,000 – was flat. Rentals of single-family homes and townhomes/condominiums registered another strong month. HAR will publish its January 2024 Rental Home Update next Wednesday, February 21.

“January was an unexpectedly positive month for Houston housing, but we don’t want to get ahead of ourselves because we know that consumers are still keeping a wary eye out for interest rates and inflation,” said HAR Chair Thomas Mouton with Century 21 Exclusive. “Rental housing is still proving to be a viable option for hesitant buyers as it also had strong activity in January.”

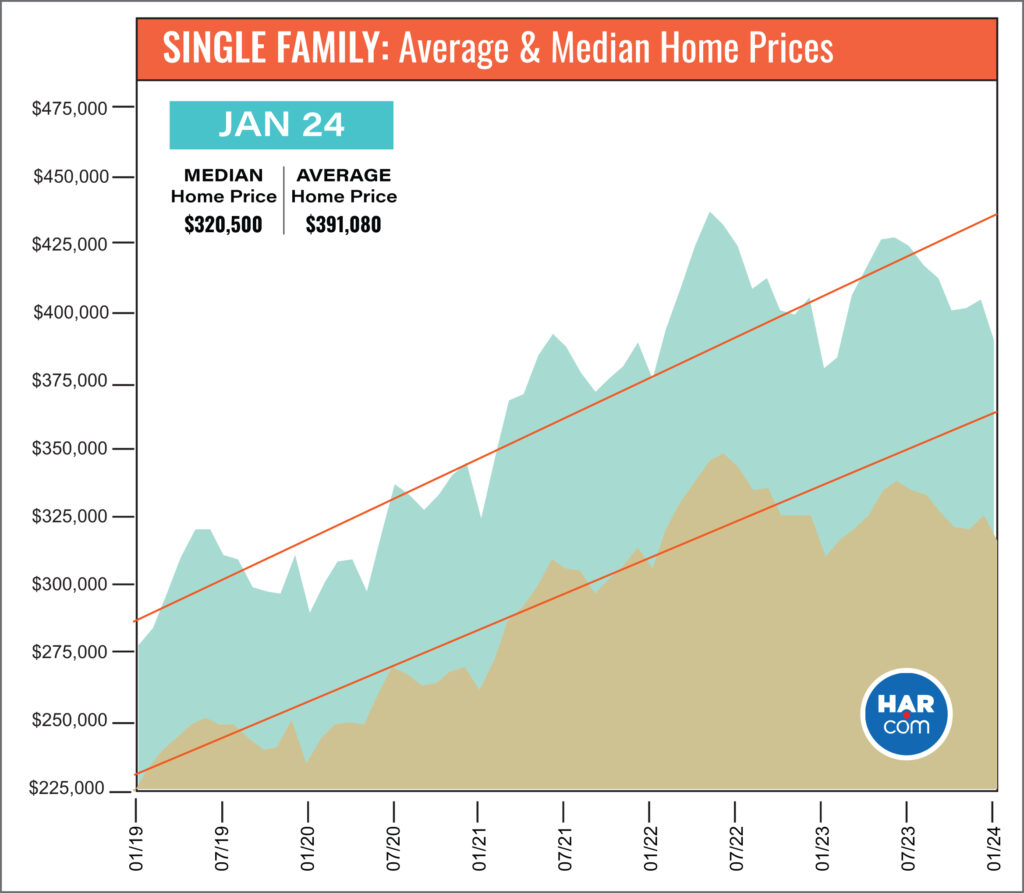

The average price of a single-family home throughout Greater Houston rose 2.7 percent to $391,080 and the median price increased 2.1 percent to $320,500. That marks the first time that the average price has been below $400,000 since February 2023.

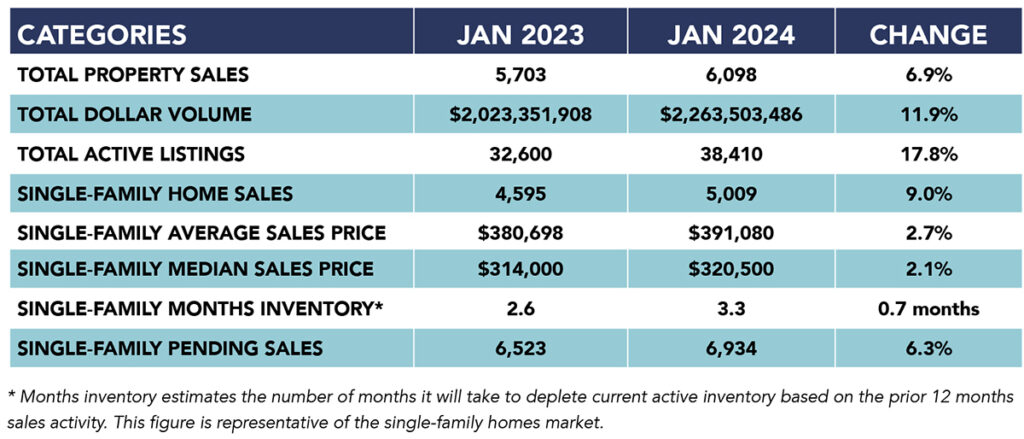

January Monthly Market Comparison

January marked only the second time in two years that single-family homes sales were in positive territory with sales climbing 9.0 percent year-over-year. The last time was in November 2023 when sales rose 5.4 percent.

In addition to the increase in single-family sales volume, total property sales rose 6.9 percent and total dollar volume jumped 11.9 percent from $2 billion to $2.3 billion. Single-family pending sales rose 6.3 percent. Active listings, or the total number of available properties, were 17.8 percent ahead of the 2023 level.

Months of inventory expanded from a 2.6-months supply last January to 3.3 months, matching December’s supply level, but slightly below the 3.5-months supply that prevailed in October and November 2023. Housing inventory nationally is at a 3.2-months supply, according to the latest report from the National Association of Realtors (NAR). A 4.0- to 6.0-month supply is generally considered a “balanced market” in which neither buyer nor seller has an advantage.

Single-Family Homes Update

January delivered good news to the Houston housing market with positive indicators across the board. Single-family home sales experienced only the second increase in two years, climbing 9.0 percent year-over-year with a total of 5,009 units sold across the Greater Houston area versus 4,595 in 2023.

The average price rose 2.7 percent to $391,080 while the median price rose 2.1 percent to $320,500. That is the first time that the average price has been below $400,000 since February 2023.

Days on Market, or the actual time it took to sell a home, eased slightly from 60 to 58 days. Months of inventory registered a 3.3-months supply for the second consecutive month and compares to 2.6 months a year earlier. The current national supply stands at 3.2 months, as reported by NAR.

Broken out by housing segment, January sales performed as follows:

- $1 – $99,999: decreased 6.4 percent

- $100,000 – $149,999: unchanged

- $150,000 – $249,999: unchanged

- $250,000 – $499,999: increased 13.0 percent

- $500,000 – $999,999: increased 16.7 percent

- $1M and above: increased 15.4 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 3,488 in January, up 8.2 percent from the same month last year. The average price rose 3.7 percent to $387,520 and the median sales price rose 3.3 percent to $310,000.

For HAR’s Monthly Activity Snapshot (MAS) of the January 2024 trends, please click HERE to access a downloadable PDF file.

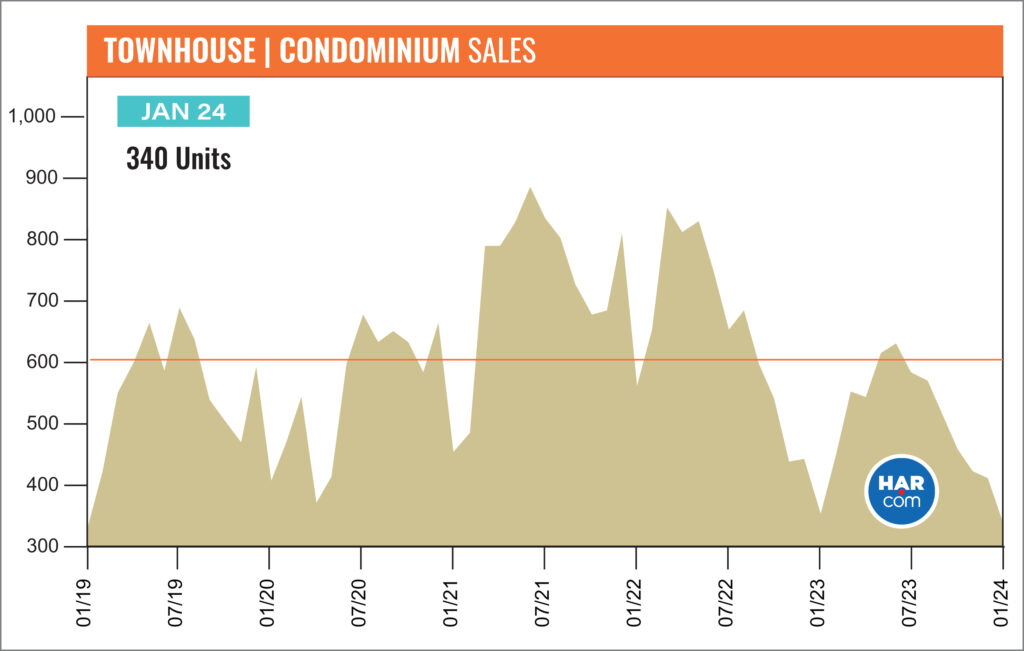

Townhouse/Condominium Update

January saw a continuation of the steady decline in sales of townhomes and condominiums that prevailed throughout 2023. Sales fell 4.0 percent year-over-year with 340 closed sales versus 354 a year earlier. That is the smallest one-month sales volume since last January.

The average price of townhomes and condominiums rose 7.0 percent to $247,437 and the median price jumped 14.1 percent to $223,000. Inventory grew from a 2.0-months supply to 3.7 months, matching the November 2023 level.

Houston Real Estate Highlights in January

- Single-family home sales rose 9.0 percent year-over-year, the second increase in two years;

- Days on Market (DOM) for single-family homes went from 60 to 58 days;

- Total property sales rose 6.9 percent with 6,098 units sold;

- Total dollar volume was up 11.9 percent to $2.3 billion;

- The single-family median price rose 2.1 percent to $320,500;

- The single-family average price rose 2.7 percent to $391,080, the first time that figure has been below $400,000 since last February;

- Single-family home months of inventory registered a 3.3-months supply, up from 2.6 months a year earlier;

- Townhome/condominium sales continue the declines that prevailed all through 2023, falling 4.0 percent, with the median price up 14.1 percent to $223,000 and the average price up 7.0 percent to $247,437.