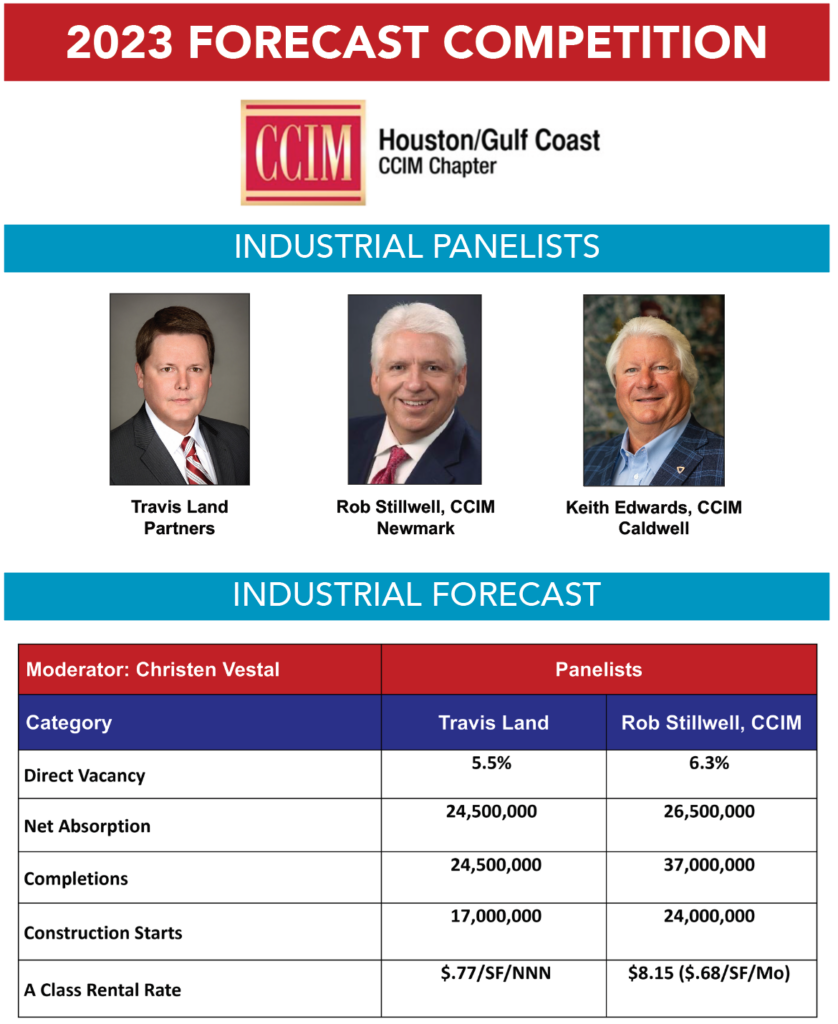

During the 2023 CCIM Forecast Competition, industrial experts Travis Land, SIOR with Partners, Rob Stillwell, CCIM with Newmark, and land expert Keith Edwards, CCIM of Caldwell Companies reported Houston’s industrial market is doing very well, with direct vacancy rates projected to remain between 5.5% to 6.3%.

The consensus is the market is now stabilizing, slowing down from the feverish pace between 2020 and 2022 when record numbers were set for construction, completions, and net absorption during several consecutive quarters. However, there are challenges ahead for industrial tenants, such as envisioning two-year projections with everything from cap rates to operating expenses to tenant improvements continuing to increase. Plus, rental costs are difficult to pinpoint, as some landlords are reportedly not quoting specific rents but averaging the last highest rents due to the quickly changing market.

New industrial development is being driven by both logistics firms and consumer companies searching for large distribution facilities. The Houston area’s significant population growth is fueling the consistent increases in Port Houston activity, which in turn has resulted in expansions by many international groups working near the Port. Major distribution facilities continue to be built for consumer products in the Northwest and West and along the Grand Parkway, where everyone is chasing growth in these regions. Additionally, a shortage of smaller, single-tenant buildings available may bring development of that type of product back into play.

Source: Patsy Fretwell is a guest contributor with more than 30 years of experience in real estate market research.