Despite sliding oil prices, mid-range housing holds its own

The Houston housing market kicked off 2016 with a strong month of sales, only about 2 percent off the January record, despite the ongoing effects of strains in the energy industry. Single-family homes priced between $150,000 and $250,000 saw year-over-year sales increase by nearly 9 percent while total property sales remained unchanged.

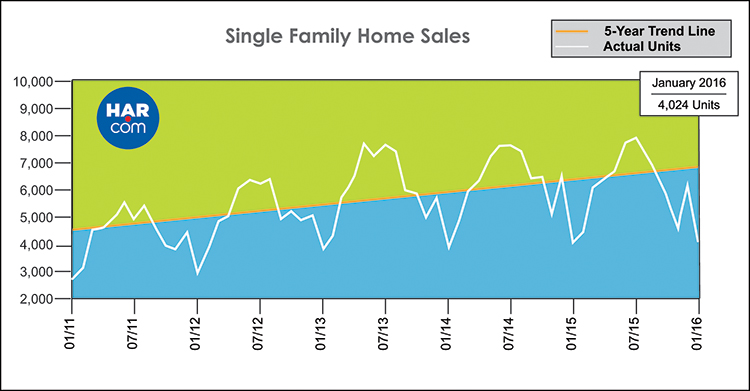

According to the latest monthly report prepared by the Houston Association of REALTORS® (HAR), January single-family home sales were down 2.1 percent versus January 2015 with a total of 4,024 sales compared to 4,109 a year earlier. An increase in new listings helped buoy a growth in inventory from a 2.5-months supply to 3.3 months.

“A lot of folks have nervously anticipated that falling oil prices would have a devastating effect on real estate, but so far, the Houston market has weathered the energy downturn without dramatic shifts in sales and pricing,” said HAR Chairman Mario Arriaga with First Group. “The most noticeable impact has been declines in the luxury market, but mid-range housing actually saw a healthy sales volume in January and inventory levels grew. HAR will continue to closely monitor the economic climate.”

In the February edition of The Economy at a Glance, the Greater Houston Partnership (GHP) reports that 23,200 jobs were added across the Houston metropolitan area in 2015, an increase of less than one percent, according to the Texas Workforce Commission. GHP is forecasting the creation of approximately 22,000 jobs in 2016.

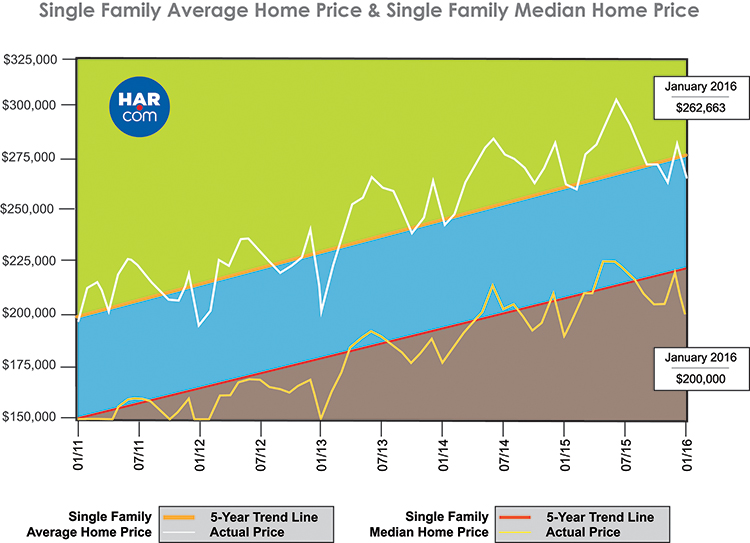

In January, the single-family home average price eked out a fractional 0.3 percent year-over-year increase, reaching $262,663 while the median price—the figure at which half of the homes sold for more and half sold for less—rose 5.3 percent to $200,000. Both figures represent all-time highs for a January in Houston.

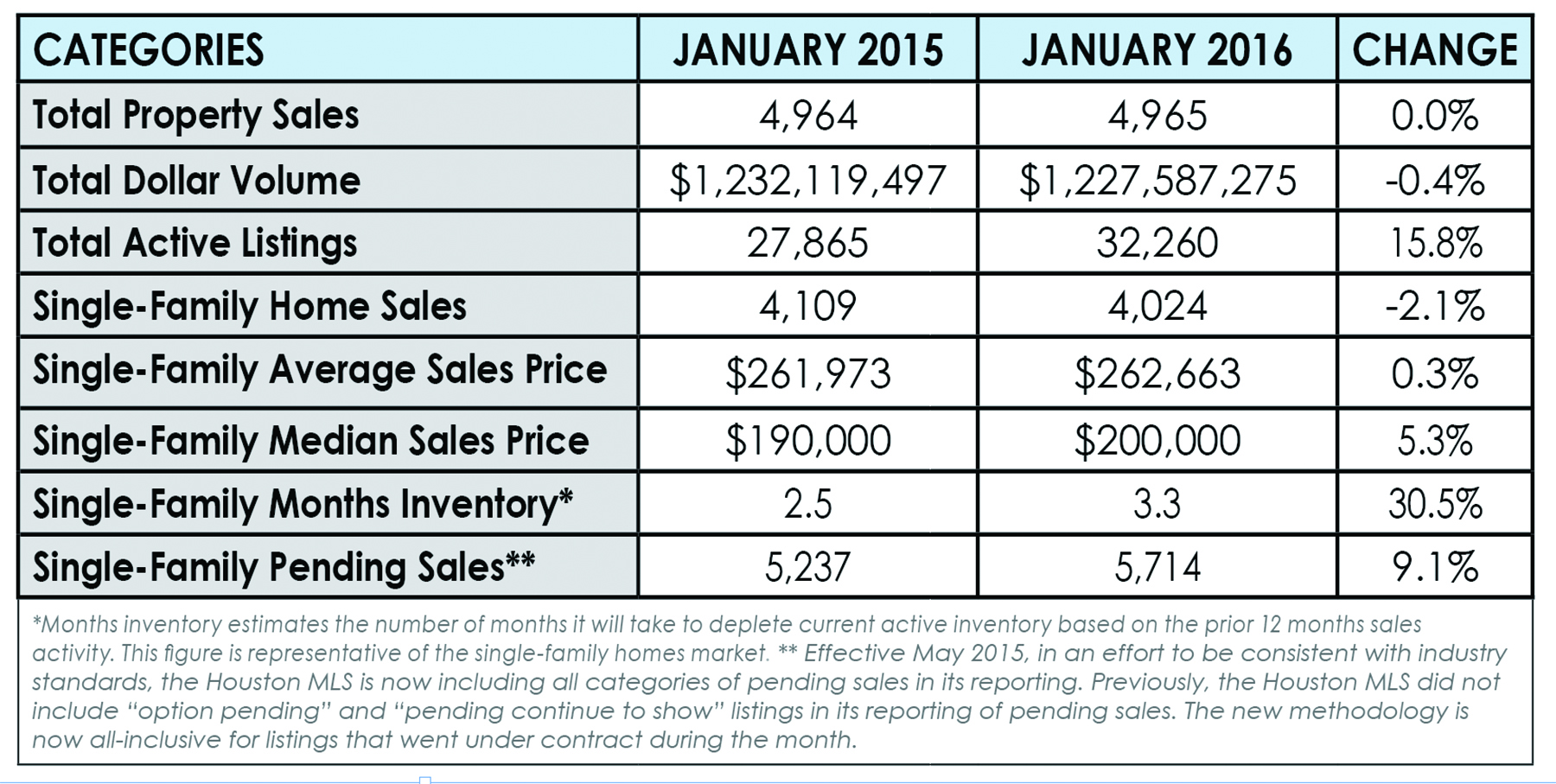

January sales of all property types in Houston totaled 4,965, unchanged from the same month last year. Total dollar volume for properties sold in January was statistically flat at $1.2 billion.

January Monthly Market Comparison

January delivered a mixed bag of indicators compared to home sales readings for January 2015. On a year-over-year basis, single-family homes sales declined slightly, total property sales and total dollar volume were flat and average and median sales prices rose.

Month-end pending sales for single-family homes totaled 5,714. That is up 9.1 percent compared to last year. Total active listings, or the total number of available properties, at the end of January rose 15.8 percent from January 2015 to 32,260.

Houston’s housing inventory has held above a 3.1-months supply since May 2015, climbing to a 3.5-months supply last summer and settling at a 3.3-months supply in January. That compares to a 2.5-months supply in January 2015. For perspective, the national supply of homes reported by the National Association of Realtors® (NAR) currently stands at 3.9 months.

Single-Family Homes Update

Single-family home sales totaled 4,024 in January, down 2.1 percent from January 2015. That marks the fourth consecutive monthly decline.

The average price increased a fractional 0.3 percent to $262,663 while the median price rose 5.3 percent year-over-year to $200,000. Both are record highs for a January in Houston. Days on Market (DOM), or the number of days it took the average home to sell, edged up to 61 days versus 57 in 2015.

Broken out by housing segment, January sales performed as follows:

- $1 – $79,999: decreased 40.6 percent

- $80,000 – $149,999: decreased 16.2 percent

- $150,000 – $249,999: increased 8.8 percent

- $250,000 – $499,999: decreased 1.0 percent

- $500,000 and above: decreased 9.3 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 3,403 in January, down 1.6 percent versus the same month last year. The average sales price rose less than 1 percent year-over-year to $246,019 while the median sales price climbed 6.7 percent to $186,690.

Townhouse/Condominium Update

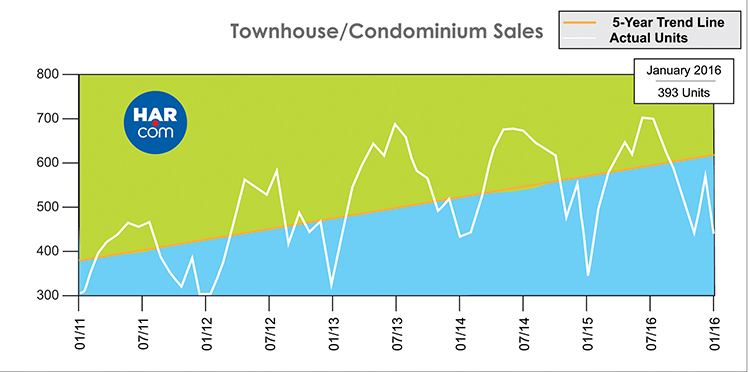

Sales of townhouses and condominiums shot up 15.6 percent in January. A total of 393 units sold compared to 340 properties in January 2015. The average price was flat at $183,076 and the median price edged up 2.4 percent to $140,000. Inventory grew from a 2.4-months supply to 3.0 months.

Lease Property Update

Demand for single-family lease homes rose 2.8 percent in January while townhomes/condominiums saw demand increase 12.2 percent. The average rent for single-family homes climbed 4.2 percent to $1,742 while the average rent for townhomes/condominiums rose just under 1 percent to $1,568.

Houston Real Estate Highlights in January

- Single-family home sales declined 2.1 percent compared to January, marking the fourth consecutive monthly decline;

- Total property sales were unchanged at 4,965 units;

- Total dollar volume was statistically flat at $1.2 billion;

- At 262,663, the single-family home average price reached its highest level ever for a January;

- At $200,000, the single-family home median price also achieved a January high;

- Single-family homes months of inventory climbed to a 3.3-months supply versus 2.5 months a year earlier;

- Townhomes/condominium sales rose 15.6 percent with the average price unchanged at $183,076 and the median price up 2.4 percent to $140,000;

- Leases of single-family homes rose 2.8 percent with rents up 4.2 percent at $1,742;

- Leases of townhomes/condominiums climbed 12.2 percent with rents up fractionally to $1,568.