Lower sales volume reflects diminished housing inventory; prices rise to new records

Houston’s persistent lack of housing inventory resulted in the market’s first home sales decline in three years in May. Thirty-four consecutive months of positive sales ended in April with flat year-over-year sales, but last month, sales volume fell for the first time since May 2011. However, sales activity for homes over $500,000 outpaced last May and coupled with low inventory levels, drove the average sales price to a new record high.

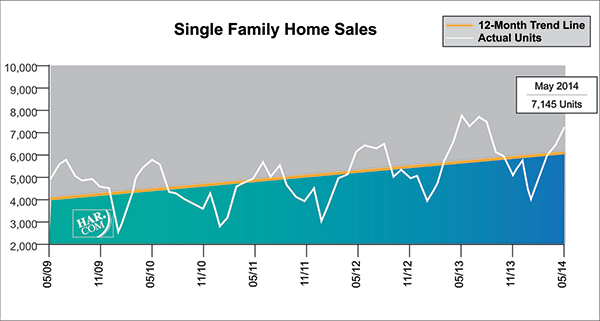

Single-family home sales totaled 7,145 units in May, a decline of 7.3 percent compared to May 2013, according to the latest monthly report prepared by the Houston Association of REALTORS® (HAR). The slower pace in sales allowed months inventory to edge up to a 2.8-months supply after holding even at 2.6 months from December through April. However, that is still lower than the 3.3-month supply of inventory in May 2013 and significantly below the national supply of 5.9 months of inventory.

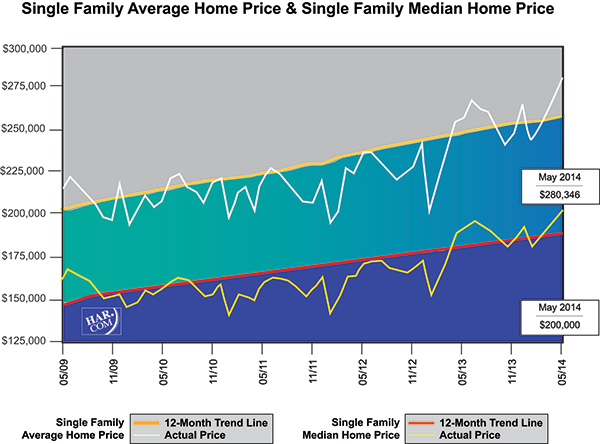

Historically low inventory levels and steady housing demand fueled by local job growth continues to drive prices higher. The average price of a single-family home jumped 9.6 percent year-over-year to $280,346. The median price—the figure at which half the homes sold for more and half for less—rose 6.4 percent to $200,000. Both are record highs for Houston.

“It was just a matter of time before our depleted supply of inventory caught up with us,” said HAR Chair Chaille Ralph with Heritage Texas Properties. “This is Economics 101: Supply and Demand. Until more homes are listed for sale and new housing is built, it’s a safe bet that there will be further sales declines and more demand for rental properties.”

Foreclosure property sales reported in the HAR Multiple Listing Service (MLS) declined again, plunging 57.4 percent compared to May 2013. Foreclosures now comprise just 4.5 percent of all property sales, down from a 9.4 percent share a year earlier. The median price of foreclosures climbed 11.0 percent to $94,349.

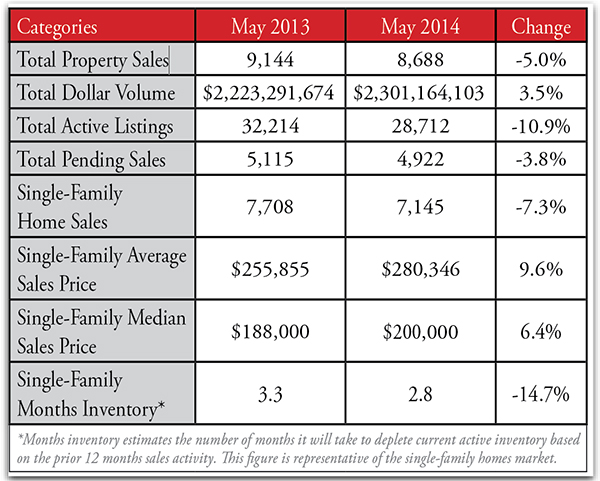

May sales of all property types totaled 8,688 units, a decline of 5.0 percent compared to the same month last year. Total dollar volume for properties sold was up, however, rising 3.5 percent to $2.3 billion versus $2.2 billion a year earlier.

May Monthly Market Comparison

Despite the first drop in total property sales in three years, total dollar volume and average and median pricing rose when compared to May 2013.

Month-end pending sales for all property classes totaled 4,922, a 3.8 percent decline versus last year, which strongly suggests that sluggish sales will persist until inventory levels start to rise. Active listings, or the number of available properties, at the end of May fell 10.9 percent to 28,712.

After holding steady at a 2.6-months supply from last December to April, this figure rose slightly to a 2.8-months supply. Nonetheless, it is down from the 3.3-months supply of a year ago. The months inventory of single-family homes across the U.S. currently stands at 5.9 months, according to the latest report from the National Association of REALTORS®.

Single-Family Homes Update

May single-family home sales in Houston totaled 7,145. That is down from May 2013 and represents the first sales decline the market has experienced since May 2011.

Home prices reached historically high levels in May. The single-family median price climbed 6.4 percent from last year to $200,000 and the average price jumped 9.6 percent year-over-year to $280,346.

Broken out by housing segment, May sales performed as follows:

- $1 – $79,999: decreased 40.5 percent

- $80,000 – $149,999: decreased 14.9 percent

- $150,000 – $249,999: decreased 2.0 percent

- $250,000 – $499,999: decreased 3.8 percent

- $500,000 – $1 million and above: increased 10.2 percent

HAR also breaks out the sales performance of existing single-family homes for the Houston market. In May 2014, existing home sales totaled 6,214. That is 4.2 percent lower than the same month last year. The average sales price rose 7.4 percent year-over-year to $263,560 while the median sales price climbed 8.6 percent to $189,000.

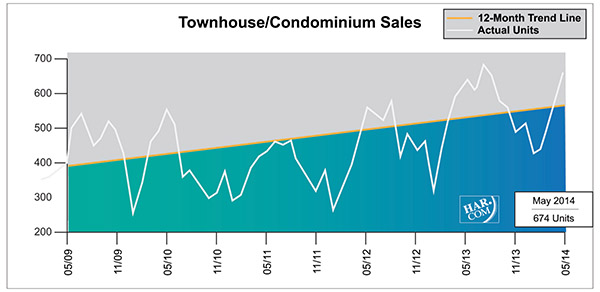

Townhouse/Condominium Update

May townhouse and condominium sales rose 4.8 percent from one year earlier. A total of 674 units sold last month compared to 643 properties in May 2013. The average price rose 2.1 percent to $193,992 and the median price increased 2.7 percent to $143,750. Inventory tumbled to a 2.6-month supply versus a 3.4-month supply in May 2013.

Lease Property Update

Houston’s lease property market flourished again in May, as for-sale properties were hard to come by. Single-family home rentals shot up 20.4 percent compared to May 2013 while year-over-year townhouse/condominium rentals edged up 1.9 percent. The average rent for a single-family home increased 4.5 percent to $1,727 and the average rent for a townhouse/condominium jumped 8.8 percent to $1,550.

Houston Real Estate Milestones in May

- Single-family home sales experienced the first year-over-year decline in three years, falling 7.3 percent versus May 2013;

- Total property sales also dropped for the first time since May 2011, slipping 5.0 percent;

- Total dollar volume rose 3.5 percent, from $2.2 billion to $2.3 billion on a year-over-year basis;

- At $200,000, the single-family home median price achieved a new record high for Houston;

- At $280,346, the single-family home average price also reached an historic high;

- After a steady 2.6-months supply of inventory from December 2013 to April, months inventory edged up to a 2.8-months supply, but is down from a 3.3-months supply in May 2013. That compares to the national average of 5.9 months;

- Rentals of single-family homes surged 20.4 percent while rentals of townhouses/condominiums edged up 1.9 percent.