Sales volume enters negative territory for the first time in seven months

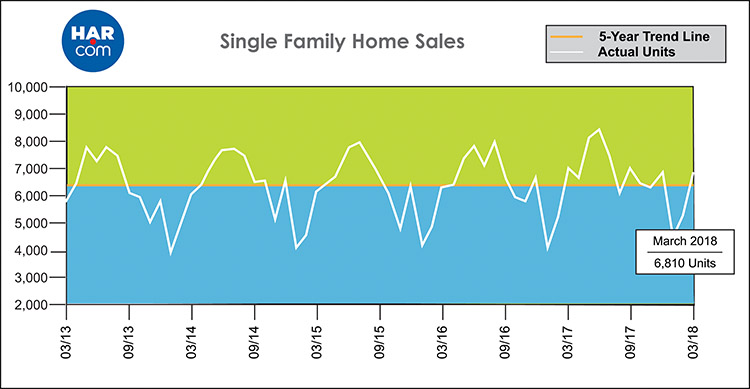

The Houston real estate market experienced its first sales slowdown since Hurricane Harvey last August, as 6,810 single-family homes sold in March versus 6,982 a year earlier. That represents a 2.5-percent decline. The rental market also saw waning consumer interest for both single-family homes and townhomes/condominiums. However, inventory of homes for sale reached the most plentiful level in four months.

According to the latest monthly report from the Houston Association of REALTORS® (HAR), the best-performing segment of the market consisted of homes priced in the $500,000 to $749,999 range, which rose 7.0 percent. The luxury market – those homes priced at $750,000 and above – was flat for the second month in a row.

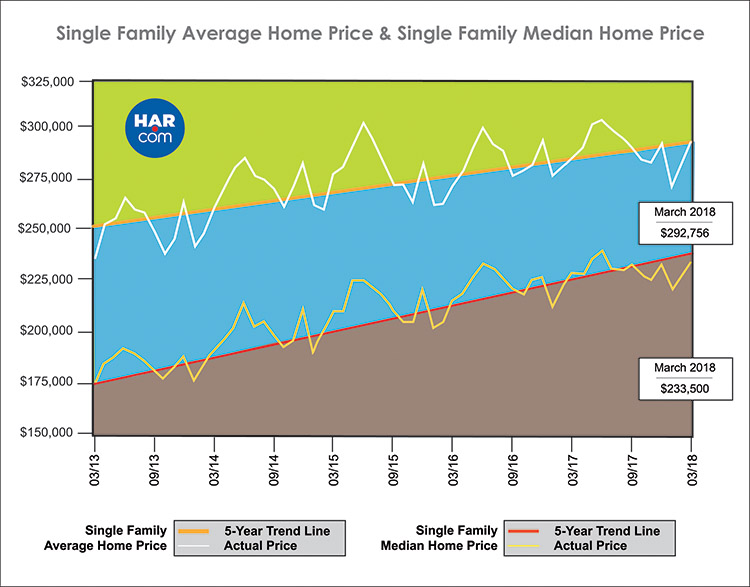

Home prices reached the highest levels ever for a March. The single-family home median price (the figure at which half of the homes sold for more and half sold for less) increased 2.4 percent to $233,500 and the average price climbed 3.0 percent to $292,756.

“We were a bit surprised that sales slowed during the lead-up to the traditional spring buying season, but are pleased to see that inventory levels have improved,” said HAR Chair Kenya Burrell-VanWormer with JPMorgan Chase. “It’s possible that consumers are hesitant to buy in light of recent stock market volatility and how that might affect their personal finances.”

March sales of all property types in Houston totaled 8,274, a decline of 2.3 percent versus the same month last year. Total dollar volume grew 0.7 percent to $2.3 billion.

Lease Property Update

Property rentals were down in March. Single-family home leases fell 9.0 percent while leases of townhomes and condominiums dropped 13.1 percent. The average rent for single-family homes rose 6.0 percent to $1,748 while the average rent for townhomes and condominiums edged up 0.7 percent to $1,496.

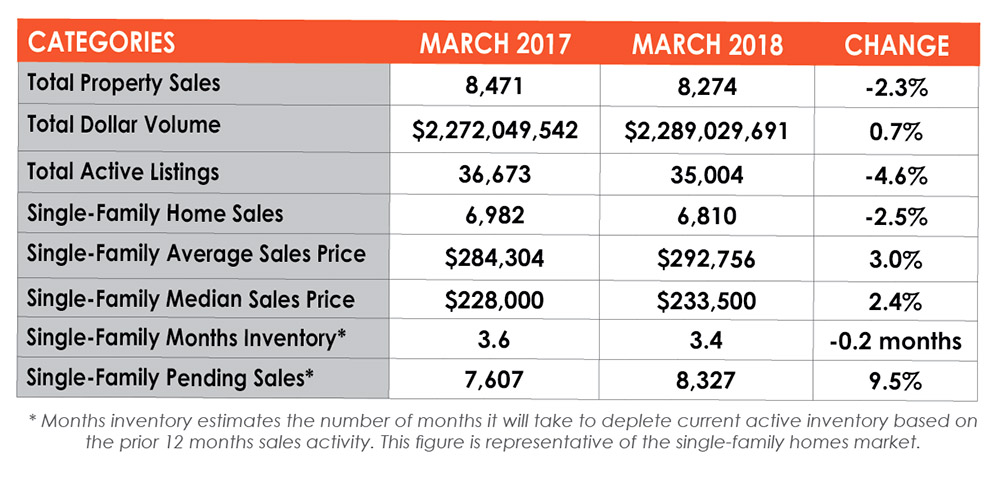

March Monthly Market Comparison

The Houston real estate market achieved mixed results for the month of March, with single-family home sales and total property sales down while pricing and total dollar volume were up compared to March 2017. Month-end pending sales for single-family homes totaled 8,327, up 9.5 percent from last year. Total active listings, or the total number of available properties, fell 4.6 percent to 35,004.

Single-family homes inventory reached a 3.4-months supply in March versus 3.6 months a year earlier, but is at its highest level of this year. It held at a 3.2-months supply throughout January and February. For perspective, housing inventory across the U.S. also stands at a 3.4-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Single-family home sales fell 2.5 percent in March, with 6,810 units sold throughout greater Houston compared to 6,982 a year earlier. Sales volume in the luxury market – defined as homes priced from $750,000 and up – was unchanged for a second consecutive month.

The median price reached the highest level ever for a March in Houston, increasing 2.4 percent to $233,500. The average price also reached a March high, up 3.0 percent to $292,756.

Days on Market (DOM), or the number of days it took the average home to sell, edged up from 61 to 63 days. Inventory narrowed from a 3.6-months supply to a 3.4-months supply year-over-year, but is at its highest level of 2018.

Broken out by housing segment, March sales performed as follows:

- $1 – $99,999: decreased 19.7 percent

- $100,000 – $149,999: decreased 17.1 percent

- $150,000 – $249,999: decreased 1.1 percent

- $250,000 – $499,999: increased 1.0 percent

- $500,000 – $749,999: increased 7.0 percent

- $750,000 and above: unchanged

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 5,528 in March, down 3.4 percent versus the same month last year. The average sales price increased 4.0 percent to $280,016 while the median sales price rose 4.8 percent to $220,000.

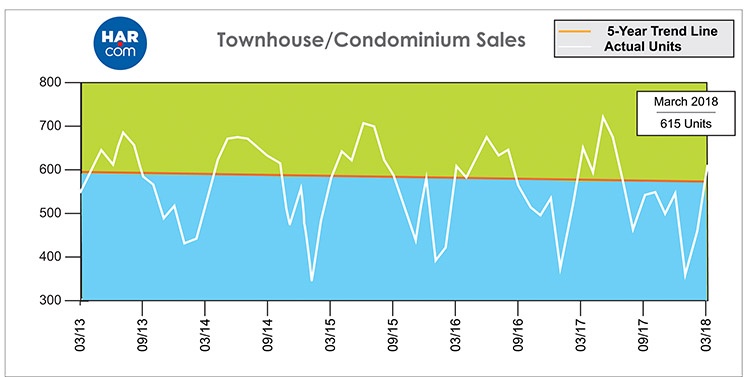

Townhouse/Condominium Update

Sales of townhomes and condominiums tumbled 5.4 percent in March, with a total of 615 units sold versus 650 a year earlier. The average price rose 3.3 percent to $211,944 while the median price jumped 9.6 percent to $172,250. Inventory declined slightly year-over-year from a 3.9-months supply to 3.7 months.

Houston Real Estate Highlights in March

- Single-family home sales fell 2.5 percent year-over-year, with 6,810 units sold;

- Days on Market (DOM) for single-family homes increased slightly from 61 days in March 2017 to 63 days this March;

- Total property sales declined 2.3 percent with 8,274 units sold;

- Total dollar volume edged up 0.7 percent to $2.3 billion;

- The single-family home median price rose 2.4 percent to $233,500, which represents a March high;

- The single-family home average price climbed 3.0 percent to a March high of $292,756;

- Single-family homes months of inventory shrank year-over-year from a 3.6-months supply to 3.4 months, the highest level of this year and the same as the national inventory level;

- Townhome/condominium sales fell 5.4 percent, with the average price up 3.3 percent to $211,944 and the median price up 9.6 percent to $172,250;

- Leases of single-family homes fell 9.0 percent with the average rent up 6.0 percent to $1,748;

- Volume of townhome/condominium leases dropped 13.1 percent with average rent up 0.7 percent to $1,496.