The Houston real estate market’s 2017 winning streak continued in March, as single-family home sales and pricing rose while housing inventory grew. The strongest sales activity took place among homes in the $250,000 to $499,999 range, followed by the luxury market ($750,000 and above), which recorded its fifth consecutive month of sales gains. Inventory levels expanded from a 3.5-months supply to 3.8 months.

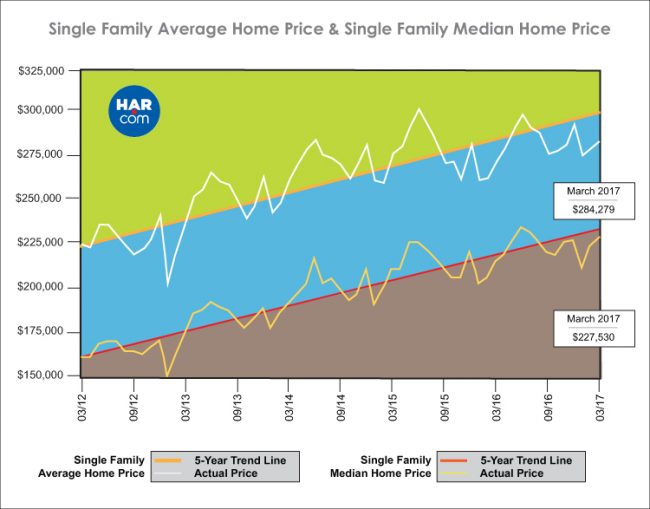

A total of 7,013 single-family homes sold in March versus 6,278 a year earlier, according to the latest monthly report produced by the Houston Association of REALTORS® (HAR). That represents an 11.7 percent increase. However, it is important to note that this gain compares to a March 2016 housing market that was facing uncertainty about the possible effects of falling oil prices.

“Houston home sales blossomed in March, but we also so tremendous activity in the rental market,” said HAR Chair Cindy Hamann with Heritage Texas Properties. “A healthy pace of new listings helped inventory levels grow, which is critical if we are to maintain the positive momentum.”

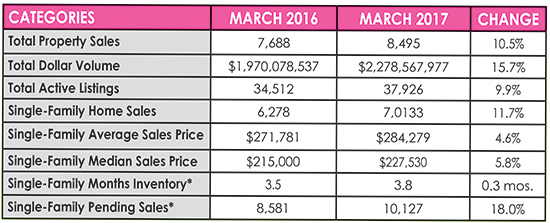

The single-family home median price (the figure at which half of the homes sold for more and half sold for less) climbed 5.8 percent to $227,530. That marks the highest median price ever for a March. The average price rose 4.6 percent to $284,279, which also represents a March high.

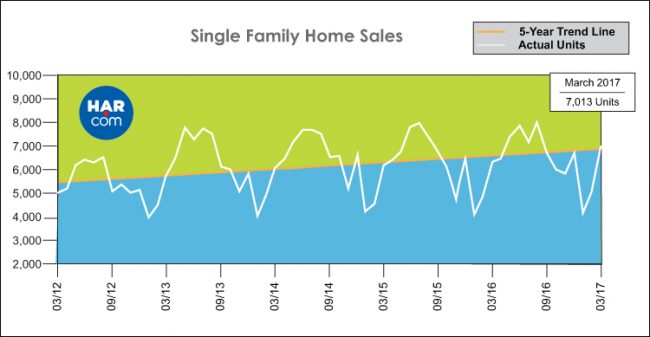

March sales of all property types in Houston totaled 8,495, up 10.5 percent from the same month last year. Total dollar volume for properties sold in March rocketed 15.6 percent to $2.3 billion.

March Monthly Market Comparison

The Houston real estate market enjoyed across-the-board gains in all statistical indicators during the month of March, with single-family home sales, total property sales, total dollar volume and pricing all up versus March of 2016.

Month-end pending sales for single-family homes totaled 10,127, an increase of 18.0 percent compared to last year. Total active listings, or the total number of available properties, jumped 9.9 percent from March 2016 to 37,926.

Single-family homes inventory grew from a 3.5-months supply to 3.8 months. For perspective, housing inventory across the U.S. also currently stands at a 3.8-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Single-family home sales totaled 7,013, up 11.7 percent from 6,278 in March 2016, when the market was on edge about weakness in the energy industry. The median price rose 5.8 percent to a March high of $227,530. The average price climbed 4.6 percent to $284,279, also a record high for a March. Days on Market (DOM), or the number of days it took the average home to sell, rose slightly to 60 days versus 58 last year.

Broken out by housing segment, March sales performed as follows:

- $1 – $99,999: decreased 14.8 percent

- $100,000 – $149,999: decreased 8.1 percent

- $150,000 – $249,999: increased 11.8 percent

- $250,000 – $499,999: increased 23.1 percent

- $500,000 – $749,999: increased 11.0 percent

- $750,000 and above: increased 19.0 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 5,839 in March, up 13.3 percent versus the same month last year. The average sales price increased 7.6 percent to $270,122 while the median sales price jumped 8.2 percent to $211,000.

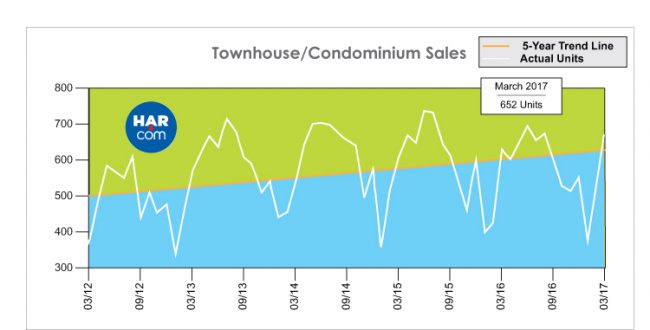

Townhouse/Condominium Update

Townhome and condominium sales were up again in March, with 652 units selling versus 607 a year earlier. That represents an increase of 7.4 percent. The average price rose 3.4 percent to $200,556, while the median price was flat at $154,250. Inventory grew from a 3.5-months supply to 4.0 months.

Lease Property Update

The lease market exploded in March, with strong consumer demand among both single-family and townhome/condominium properties. Single-family home leases surged 36.6 percent while townhome/condominium leases leapt 37.8 percent. The average rent for single-family homes declined 4.9 percent to $1,647, while the average rent for townhomes/condominiums dropped 5.6 percent to $1,487.

Houston Real Estate Highlights in March

- Single-family home sales rose 11.7 percent year-over-year with 7.013 units sold, the third consecutive monthly gain of 2017;

- Total property sales jumped 10.5 percent with 8,495 units sold;

- Total dollar volume soared 15.7 percent to $2.3 billion;

- At $227,530, the single-family home median price rose 5.8 percent to a March high;

- The single-family home average price climbed 4.6 percent to $284,279, which was also the highest level for a March;

- Single-family homes months of inventory grew to a 3.8-months supply, matching the national level reported by NAR;

- Townhome/condominium sales increased 7.4 percent, with the average price up 3.4 percent to $200,556 and the median price unchanged at $154,250;

- Leases of single-family homes rocketed 36.6 percent with average rent down 4.9 percent to $1,647;

- Volume of townhome/condominium leases surged 37.8 percent with average rent down 5.6 percent to $1,487.