Single-family home sales decline for the first time since January while inventory reaches the highest level in four years

The greater Houston real estate market experienced its first sales decline in six months in July, with the sharpest drop in volume reported among homes on the highest and lowest ends of the pricing spectrum.

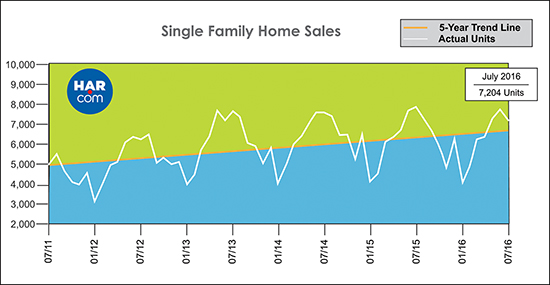

According to the latest monthly report prepared by the Houston Association of REALTORS® (HAR), a total of 7,204 homes sold in July compared to 7,898 a year earlier. That represents a drop of 8.8 percent, the first decline since January. However, on a year-to-date basis, home sales are still up about one percent compared to this point in 2015.

Inventory levels enjoyed their biggest bump yet, rising from a 3.5-months supply to 4.0 months. That is the largest supply of homes since November 2012 when it stood at 4.1 months.

“We never like to see a decline in home sales, but it’s helpful to remember that our comparisons each month are to a record year in 2015,” said HAR Chairman Mario Arriaga with First Group. “July was the first time in several months when even mid-range housing saw declines. It’s hard to identify a single cause for the drop in sales, whether it’s a possible trickle-down effect of falling oil prices or prospective buyers holding out, but Houston’s housing market is still healthy overall, and HAR will continue to monitor conditions as we transition into the fall months.”

The single-family home median price—the figure at which half of the homes sold for more and half sold for less—rose 4.1 percent to $230,000. That is the highest median price ever for a July and the second highest of all time. The highest median ever was $233,000, reached in June of this year. The average price declined a fractional 0.5 percent in July to $292,316.

July sales of all property types in Houston totaled 8,571, down 8.6 percent from the same month last year. Total dollar volume for properties sold in July fell 9.0 percent to $2.4 billion.

July Monthly Market Comparison

Houston’s monthly housing indicators were mixed in July compared to a year earlier. On a year-over-year basis, single-family homes sales and total property sales were down along with total dollar volume, the median price reached a record high for a July while the average price dropped slightly and inventory grew to the largest level in four years.

Month-end pending sales for single-family homes totaled 7,979, an increase of 11.4 percent compared to last year. Total active listings, or the total number of available properties, at the end of July climbed 12.7 percent from July 2015 to 37,952.

Single-family homes inventory jumped from a 3.5-months supply to 4.0 months, the highest level since November 2012 when it stood at 4.1 months. For perspective, housing inventory across the U.S. currently stands at a 4.6-months supply, according to the latest report from the National Association of REALTORS® (NAR).

Single-Family Homes Update

Single-family home sales totaled 7,204 in July, down 8.8 percent from July 2015 and the first decline since January 2016.

The median price rose 4.1 percent to a July high and second all-time high of $230,000. The average price declined 0.5 percent to $292,316. Days on Market (DOM), or the number of days it took the average home to sell, edged up to 50 days versus 45 last year.

Broken out by housing segment, July sales performed as follows:

- $1 – $79,999: decreased 43.3 percent

- $80,000 – $149,999: decreased 32.8 percent

- $150,000 – $249,999: decreased 3.1 percent

- $250,000 – $499,999: decreased 1.4 percent

- $500,000 and above: decreased 21.7 percent

HAR also breaks out the sales figures for existing single-family homes. Existing home sales totaled 6,143 in July, down 10.3 percent versus the same month last year. The average sales price was flat at $274,861 while the median sales price rose 6.1 percent to $217,500.

Townhouse/Condominium Update

Townhome and condominium sales fell 7.4 percent with 649 units selling in July versus 701 a year earlier. The average price declined 2.5 percent to $197,104 while the median price climbed 4.5 percent to $159,900. Inventory grew from a 3.0-months supply to 3.5 months.

Lease Property UpdateThe lease market was strong again in July. Single-family home leases rose 2.3 percent, while townhome/condominium leases jumped 10.6 percent. The average rent for single-family homes ticked up to $1,879 and the average rent for townhomes/condominiums held steady at $1,630.

Houston Real Estate Highlights in July

- Single-family home sales fell 8.8 percent with a total of 7,204 units sold;

- On a year-to-date basis, single-family home sales are up about one percent;

- Total property sales fell 8.6 percent to 8,571 units;

- Total dollar volume declined 9.0 percent to $2.4 billion;

- At $230,000, the single-family home median price rose 4.1 percent to a July high and second all-time high;

- The single-family home average price declined 0.5 percent to $292,316;

- Single-family homes months of inventory climbed to a 4.0-months supply, its strongest level since November 2012;

- Townhome/condominium sales fell 7.4 percent with the average price down 2.5 percent to $197,104 and the median price up 4.5 percent to $159,900;

- Leases of single-family homes were up 2.3 percent with rents up slightly to $1,879;

- Leases of townhomes/condominiums soared 10.6 percent with rents flat at $1,630.