Numbers compare favorably to 2010, a period of increased activity spurred by the home buyer tax credit

Numbers compare favorably to 2010, a period of increased activity spurred by the home buyer tax credit

In what reads like a carbon copy of the February housing report, local home sales fell slightly in March while the average price of those homes rose. The lower sales volume compares to sales activity in March 2010 that was driven, in part, by the federal government’s first-time home buyer tax credit incentive.

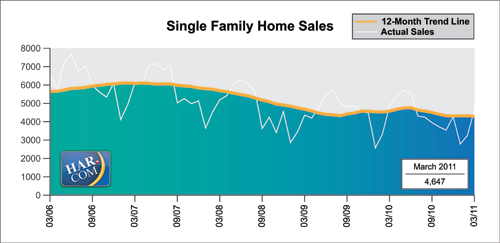

According to the latest monthly data compiled by the Houston Association of REALTORS® (HAR), March sales of single-family homes fell 4.4 percent versus one year earlier. As in February, the popular middle segments of the Houston housing market, consisting of homes priced between $80,000 and $250,000, experienced declining sales while the low and high ends saw an increase in number of sales. Compared to March of 2009, a year without unusual market factors such as Hurricane Ike in 2008 and the 2010 tax credit, single-family home sales were up 6.6 percent.

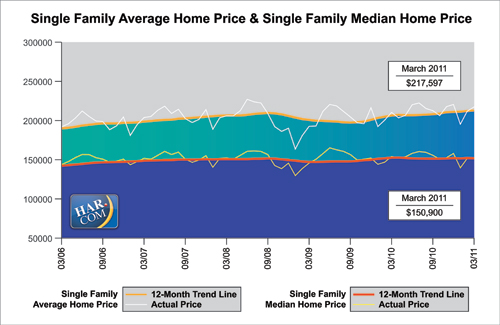

Luxury home sales boosted the average price of a single-family home for a third straight month. The average price rose 3.3 percent from March 2010 to $217,597, the highest level for a March in Houston. The March single-family home median price—the figure at which half of the homes sold for more and half sold for less—dipped 1.7 percent year-over-year to $150,900.

Foreclosure property sales reported in the Multiple Listing Service (MLS) increased 3.6 percent in March compared to one year earlier. Foreclosures comprised 23.5 percent of all property sales in March. The median price of March foreclosures fell 7.1 percent to $82,000 on a year-over-year basis.

March sales of all property types in Houston totaled 5,509, down 5.0 percent compared to March 2010. Total dollar volume for properties sold during the month declined 2.3 percent to $1.1 billion versus $1.2 billion one year earlier.

“The year-over-year March 2011-March 2010 analysis is a bit skewed in the sense that it continues to reflect a comparison to the period a year ago where the home buyer tax credit encouraged consumers to purchase a home prior to the April 30 deadline,” said Carlos P. Bujosa, HAR chairman and VP at Transwestern. “It is encouraging that properties continue to go under contract at the levels we saw last year, a time when the tax credit was a huge incentive.”

March Monthly Market Comparison

The month of March brought Houston’s overall housing market largely negative results when all listing categories are compared to March of 2010. Total property sales, total dollar volume and median price declined, while average price rose on a year-over-year basis.

Month-end pending sales for March totaled 4,190, down 1.2 percent from last year. That suggests the likelihood of lower demand when the April figures are tallied. The number of available properties, or active listings, at the end of March rose 4.2 percent from March 2010 to 51,091. The growth in available housing pushed the March inventory of single-family homes to 7.6 months compared to 6.7 months one year earlier. That means that it would take 7.6 months to sell all the single-family homes on the market based on sales activity over the past year. The figure still compares favorably to the national inventory of single-family homes of 8.6 months reported by the National Association of REALTORS® (NAR).

Single-Family Homes Update

March sales of single-family homes in Houston totaled 4,647, down 4.4 percent from March 2010. This follows a 2.5 percent decline in February and 8.2 percent jump in January, which was the first increase in seven months. When compared to March of 2009, a year in which there were no unusual real estate market influences such as Hurricane Ike in 2008 and the home buyer tax credit in 2010, single-family home sales were up 6.6 percent.

Broken out by segment, March sales of homes priced below $80,000 climbed 25.6 percent; sales of homes in the $80,000-$150,000 range dropped 11.5 percent; sales of homes between $150,000 and $250,000 declined 16.7 percent; sales of homes ranging from $250,000-$500,000 ticked up 3.1 percent; and sales of homes that make up the luxury market—priced from $500,000 and up—rose 7.6 percent.

At $217,597, the average price of single-family homes achieved the highest levels ever for a March in Houston, up 3.3 percent compared to one year earlier. At $150,900, the median sales price for single-family homes dipped 1.7 percent versus March 2010. The national single-family median price reported by NAR is $157,000, illustrating the continued higher value and lower cost of living available to consumers in Houston.

HAR also breaks out the sales performance of existing single-family homes throughout the Houston market. In March 2011, existing home sales totaled 3,911, a 3.6 percent decrease from March 2010. The average sales price rose 2.7 percent to $201,867 compared to last year and the median sales price of $135,900 fell 4.6 percent.

Townhouse/Condominium Update

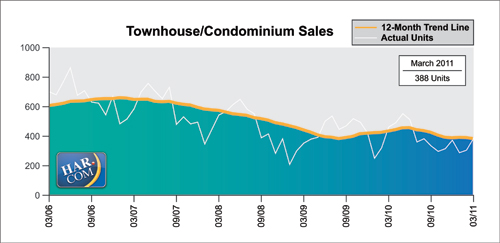

The number of townhouses and condominiums that sold in March slid 16.6 percent compared to one year earlier. In the greater Houston area, 388 units were sold last month versus 465 properties in March 2010.

The average price fell 9.8 percent to $145,206 from March 2010 to March 2011. The median price of a townhouse/condominium declined 6.5 percent to $115,000.

Lease Property Update

Demand for single-family home rentals soared 31.4 percent in March compared to one year earlier. Year-over-year townhouse/condominium rentals increased 24.0 percent.

Houston Real Estate Milestones in March

- At $217,597, the average price of a single-family home reached the highest level ever recorded for a March in Houston;

- Single-family home rentals rose 31.4 percent;

- Townhouse/condominium rentals increased 24.0 percent;

- 7.6 months inventory of single-family homes compares favorably to the national average of 8.6 months.