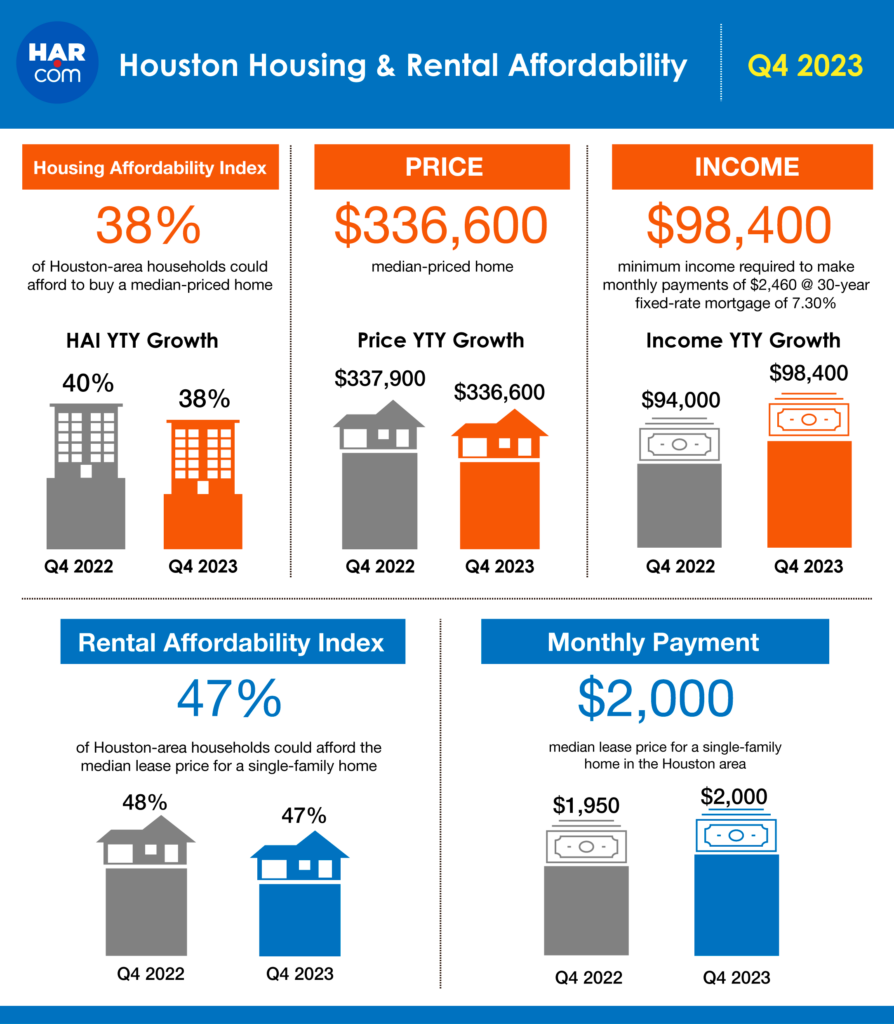

Thirty-eight percent of Houston-area households could afford to buy a median-priced home in Q4 2023

HOUSTON — (February 8, 2024) —Prospective homebuyers continued to face unprecedented challenges in the fourth quarter of 2023, bearing the impact of historically high interest rates, according to new data from the Houston Association of Realtors (HAR).

HAR’s latest quarterly Housing Affordability Index (HAI) finds that 38 percent of Houston-area households could afford to purchase a median-priced home in the metro area in the last quarter of 2023, a modest increase from 35 percent in the third quarter. However, housing affordability was down from 40 percent in the fourth quarter of 2022.

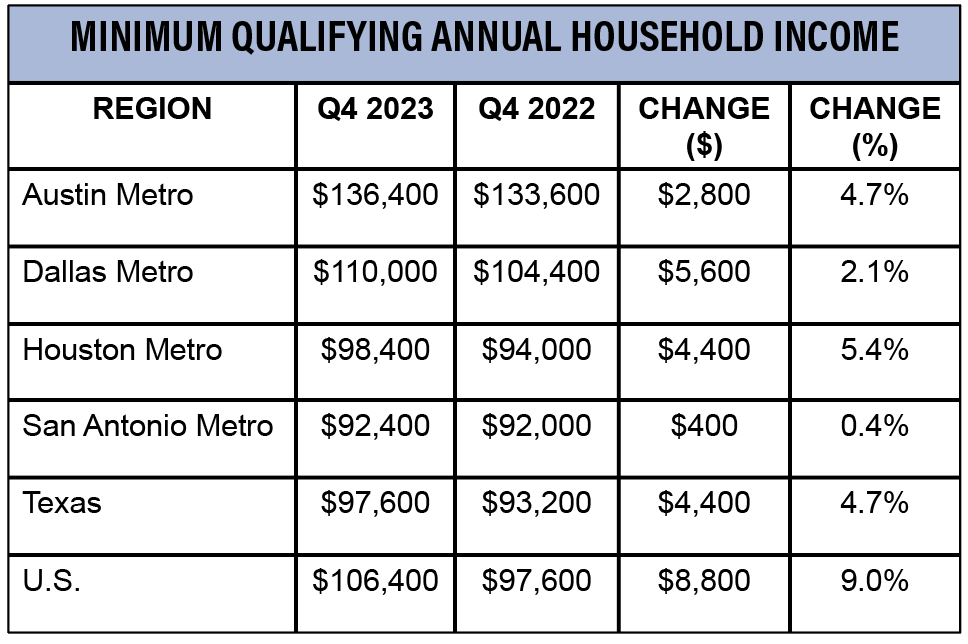

The median home price in the Houston area declined 0.4 percent to $336,600 in the fourth quarter of 2023. The monthly mortgage payment on a 30-year, fixed-rate loan, including taxes and insurance, rose to $2,460 from $2,350 a year ago. The average interest rate hit a 20-year high of 7.30 percent in the fourth quarter of 2023 compared to 6.66 percent during the same time in 2022. These elevated rates have contributed to a rise in the overall cost of buying a home. As a result, households needed 4.7 percent more income annually than they did a year ago to buy a median-priced home with a minimum income of $98,400.

Thirty-six percent of households across Texas could afford to buy a median-priced home in the fourth quarter of last year. Statewide affordability is down from 38 percent in the fourth quarter of 2022. An annual household income of $97,600 was needed to qualify for the purchase of a $334,166 median-priced home statewide.

The affordability challenges are not unique to our region. Thirty-four percent of the nation’s households could afford the $391,700 median-priced home, which required a minimum annual income of $106,400 to make monthly payments of $2,660. Nationwide affordability was down from 37 percent in the fourth quarter of 2022.

The chart below shows how the minimum annual household income needed to purchase a home has changed year-over-year.

“Elevated mortgage rates created challenges for prospective homebuyers throughout 2023, and this prompted many consumers to postpone their homebuying plans and turn to the rental market,” said HAR Chair Thomas Mouton with Century 21 Exclusive. “As home prices moderate and interest rates ease, we anticipate more favorable market conditions for homebuyers throughout 2024.”

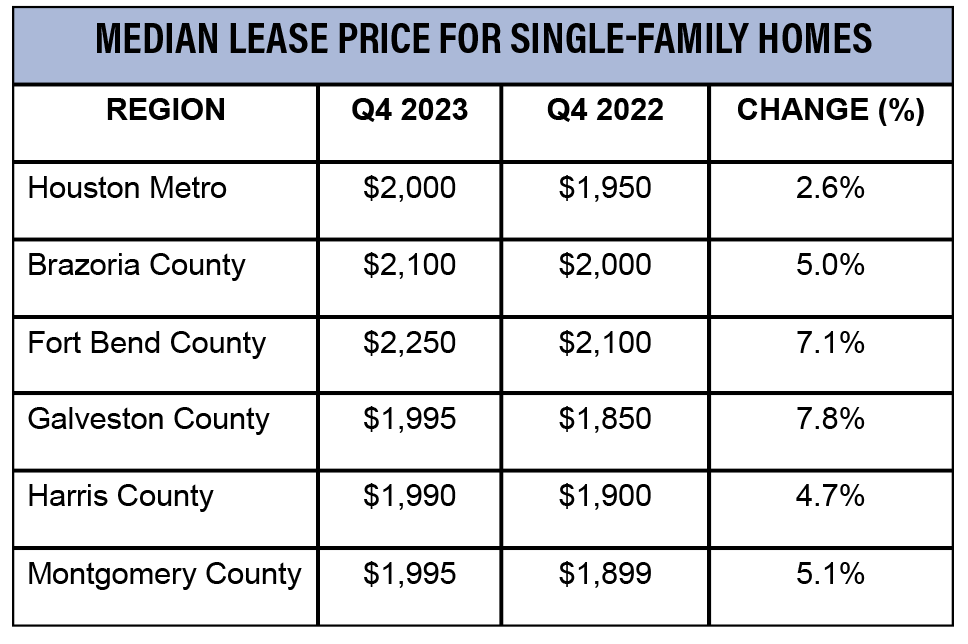

Lease prices for a single-family home increased across most of the Houston metro area in the fourth quarter of last year, according to HAR’s Rental Affordability Index, which measures the percentage of households that can afford to pay the median monthly rent for a single-family home in the Greater Houston area. The median lease price increased 2.6 percent year-over-year to $2,000 in the fourth quarter of 2023.

Rental affordability was down slightly from 48 percent in the fourth quarter of 2022 to 47 percent during the same time period of 2023. Households in the Houston area needed to earn a minimum annual income of $80,000 to afford the median lease payment on a home. This does not include the security deposit or cost of utilities.

Highlights from the Q4 2023 Housing Affordability Report:

Compared to the fourth quarter of 2022, housing affordability declined in seven tracked counties (Fort Bend, Galveston, Harris, Liberty, Matagorda, Polk and Walker). Affordability increased in eight counties (Austin, Brazoria, Chambers, Grimes, Montgomery, San Jacinto, Waller and Wharton).

The most affordable county was Chambers County where 52 percent of households could afford to purchase a median-priced home.

In Harris County, Pasadena was the most affordable community. Forty-four percent of Harris County households made the minimum annual income of $76,400 to afford a median-priced home in Pasadena. West University Place was the least affordable with only three percent of households in Harris County able to afford to purchase the median-priced home in this community.

In Fort Bend County, Rosenberg was the most affordable area—48 percent of Fort Bend County households were able to afford the median-priced home in Rosenberg based on the minimum annual income of $109,200. Fulshear was the least affordable (21 percent).

In Montgomery County, The Magnolia Area was the most affordable community—51 percent of households in the county were able to afford the median-priced home in the Magnolia Area based on the annual income. The Woodlands was the least affordable (27 percent) with households needing a minimum annual income of $165,200.

In Brazoria County, Angleton was the most affordable—61 percent of Brazoria County households were able to afford the median-priced home in Angleton based on the annual income. Manvel was the least affordable (21 percent).

In Galveston County, La Marque was the most affordable—53 percent of Galveston County households were able to afford the median-priced home in La Marque based on the annual income. Friendswood was the least affordable (18 percent).

Highlights from the Q4 2023 Rental Affordability Report:

Compared to the fourth quarter of 2022, rental affordability declined in all tracked counties except Chambers County where it was unchanged.

Lease prices were most affordable for households in Chambers and Montgomery County. Based on the median annual income, 58 percent of households in Montgomery County could afford the median monthly rent of $2,000 for a single-family home.