Slowing home sales and rising inventory reflect a move toward pre-pandemic conditions

The Houston housing market continued easing its way to pre-pandemic levels with an August that marked the fifth consecutive month of declining sales and rising inventory. However, a surge in single-family leases demonstrates that consumers didn’t just suspend purchases due to rising prices and interest rates, but they pivoted to the rental market. These factors have enabled housing inventory to grow to its highest level in two years.

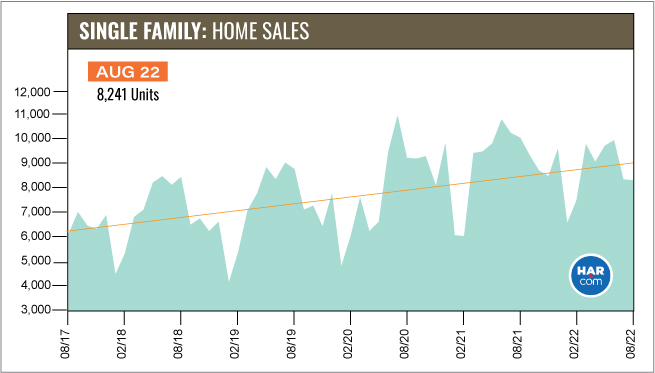

According to the Houston Association of Realtors’ (HAR) August 2022 Market Update, single-family home sales fell 16.9 percent, with 8,241 units sold compared to 9,918 in August 2021. That is the lowest one-month sales volume since February 2022. On a year-to-date basis, the market now trails 2021’s record-setting volume by 3.7 percent.

As in July, all housing segments experienced negative sales in August except the $500,000 to $1 million segment, which rose 10.0 percent. The smallest decline in sales was recorded among homes priced between $250,000 and $500,000, which fell 10.6 percent. With few homes available for sale at or below $250,000, many consumers have postponed purchase plans or shifted their focus to rental properties. [HAR’s Monthly Rental Home Update for August will be released next Wednesday, September 21].

“We are easing our way back to the housing market that existed prior to the pandemic,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene. “For the past two years, Houston housing has been like a runaway train, and what we’ve been seeing most recently is an engineer, finally at the throttle, applying the brakes so the train can pull safely into the next station. It’s important to note that transactions are still happening, just not at a whirlwind pace or record pricing levels, and that is perfectly healthy.”

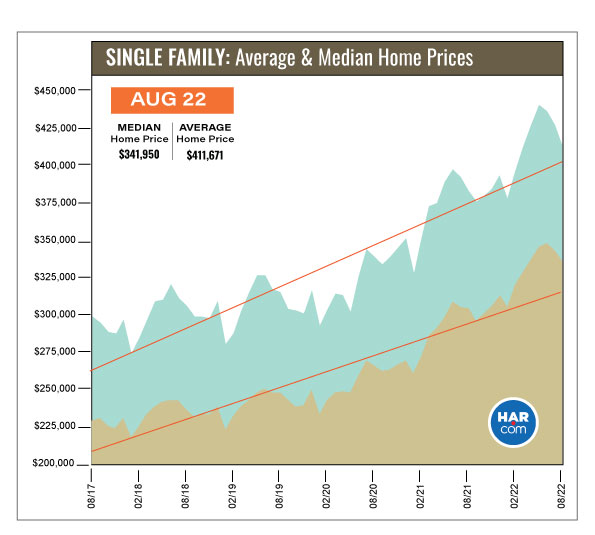

The average price of a single-family home rose 8.7 percent in August to $411,671 –below the record high of $438,591 reached in May 2022. The median price jumped 10.8 percent to $341,950, which is also below the highest median of all time, $354,440, reached in June 2022. The average price for a single-family home in Houston first shattered the $400,000 mark in March of this year. The median price has held above $300,000 since May of 2021.

After surpassing the 100-percent mark from April through June of this year, the ‘Close to Original List Price Ratio’ for single-family homes has remained below 100 percent for the past two months, meaning that fewer buyers are paying above list price for homes on the market.

AUGUST Monthly Market Comparison

Homebuyers continued to take a break from the market in August amid the pressures of record home prices and rising interest rates, keeping home sales in negative territory for a fifth straight month. Year-over-year single-family home sales fell 16.9 percent. On a year-to-date basis, sales are lagging just 3.7 percent behind last year’s record pace.

Market indicators yielded mixed readings in August. In addition to the drop in single-family home sales, total property sales and total dollar volume of sales experienced declines and pending sales slid 11.0 percent. Active listings (the total number of available properties) jumped 31.1 percent.

Months of inventory grew again in August, reaching a 2.5-months supply. That is the highest level since August of 2020 when it was 2.6 months. Housing inventory nationally stands at a 3.3-months supply, according to the latest report from the National Association of Realtors (NAR). A 6.0-months supply is generally considered make up a “balanced market,” in which neither the buyer nor the seller has an advantage.

Single-Family Homes Update

Single-family home sales fell 8.6 percent in June with 9,728 Single-family home sales fell 16.9 percent in August with 8,241 units sold across the Greater Houston area compared to 9,918 a year earlier. In August, the median price climbed 10.8 percent to $341,950 while the average price rose 8.7 percent to $411,671.

For a pre-pandemic perspective, August sales are down 5.0 percent compared to three years ago, in August 2019, when a total of 8,673 single-family homes sold. The median price then was 36.8 percent lower, at $249,975, and the average price, at $310,139, was 32.7 percent lower. However, sales are 35.3 percent above where they were five years ago, in August 2017, when volume totaled 6,090. Back then, the median price was $230,000 and the average price was $294,963 – reflecting pricing jumps of 48.6 percent and 39.6 percent, respectively. It is worth noting that the 2017 figures were affected by Hurricane Harvey.

Days on Market, or the actual time it took to sell a home, grew slightly, from 27 to 31 days. Inventory registered a 2.5-months supply compared to 1.7 months a year earlier. That is the greatest supply of homes on the market since August of 2020. The current national inventory stands at 3.3 months, as reported by NAR.

Broken out by housing segment, August sales performed as follows:

- $1 – $99,999: decreased 28.1 percent

- $100,000 – $149,999: decreased 24.4 percent

- $150,000 – $249,999: decreased 43.6 percent

- $250,000 – $499,999: decreased 10.6 percent

- $500,000 – $999,999: increased 10.0 percent

- $1M and above: decreased 13.5 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 6,739 in August, down 20.3 percent from the same month last year. The average sales price rose 8.8 percent to $408,030 while the median sales price increased 8.9 percent to $330,000. Those figures are significantly below the pricing records that were set earlier this year.

For HAR’s Monthly Activity Snapshot (MAS) of the August 2022 trends, please click HERE to access a downloadable PDF file.

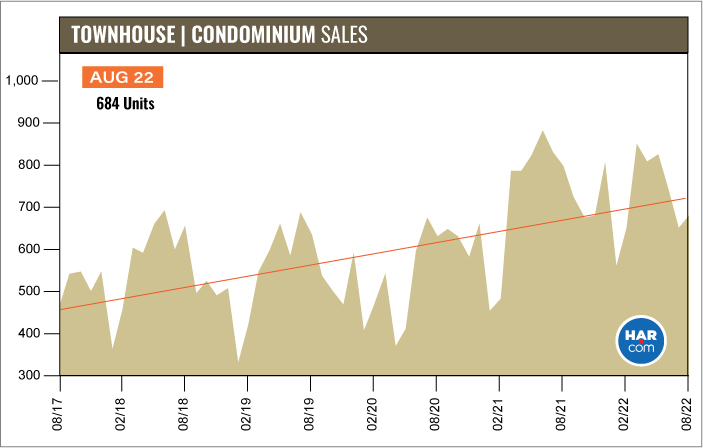

Townhouse/Condominium Update

Townhouses and condominiums saw their first decline in almost two years, dropping 15.3 percent year-over-year with 752 closed sales versus 888 a year earlier. The last time sales fell was in August of 2020. The average price increased 4.7 percent to $259,557 and the median price rose 2.7 percent to $220,000. Both figures are below the historic highs reached in April 2022. Inventory fell from a 2.4-months supply to 1.7 months.

Houston Real Estate Highlights in AUGUST

- Single-family home sales fell 16.9 percent year-over-year, the fifth decline of 2022 as the market continues toward a more normalized, pre-pandemic pace;

- Days on Market (DOM) for single-family homes ticked up from 27 to 31 days;

- The ‘Close to Original List Price Ratio’ for single-family homes has now remained below 100 percent for two consecutive months, meaning fewer buyers paid above list price for homes on the market;

- Total property sales were down 15.8 percent with 10,157 units sold;

- Total dollar volume was off 9.4 percent at $3.9 billion;

- The single-family average price rose 8.7 percent to $411,671;

- The single-family median price increased 10.8 percent to $341,950;

- Single-family home months of inventory registered a 2.5-months supply, up from 1.7 months a year earlier. That is the greatest inventory level since August of 2020;

- Townhome/condominium sales experienced their third consecutive monthly decline, falling 14.9 percent, with the average price up 7.2 percent to $254,383 and the median price up 8.1 percent to $217,000.