Robust supply provides fuel for strong leasing activity

With housing inventory still near the lowest levels in history and mortgage rates continuing to climb, more and more homebuyers are turning to Houston’s rental market for relief.

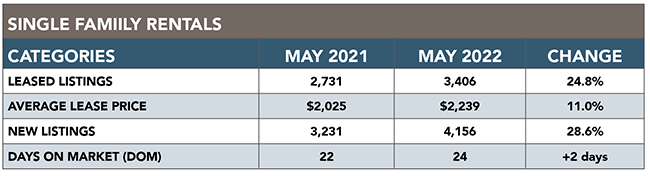

According to the Houston Association of REALTORS’ May 2022 Rental Market Update, single-family home rentals jumped 24.8 percent year-over-year, with the average rent up 11.0 percent to an all-time high of $2,239. A total of 3,407 leases were signed versus 2,7631 in May 2021. New listings of single-family rentals shot up 28.6 percent, adding to a robust supply of units for consumers who may have grown weary of the aggressive sales market. Days on Market, or the actual time it took to lease a home, edged up from 22 days to 24.

“We are seeing a surge of activity in Houston’s rental market as prices of homes for sale and interest rates move beyond the reach of some consumers,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Real Estate Gary Greene. “For now, there appears to be an adequate supply of rental properties throughout the Houston market, but that could change if demand grows.”

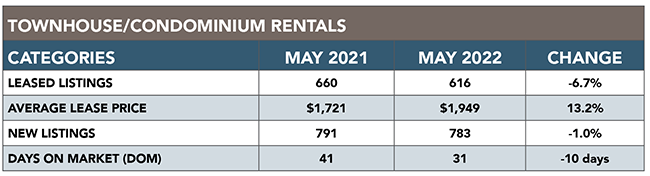

Consumers showed less interest in townhomes and condominiums for rent in May. Leases of those properties fell 6.7 percent on the year, with 616 units leased compared to 660 last May. Rents rose 13.2 percent to $1,949, which is slightly below the record high of $1,854 reached in March of 2022. New listings were down 1.0 percent. Days on Market dropped from 41 to 31 days.

HAR’s new Rental Market Update is distributed the third Wednesday of each month, one week after the release of the monthly Sales Market Update. An archive of all these reports is available in the HAR Online Newsroom at www.har.com/newsroom.