Pandemic and slumping oil prices combine to drive closed home sales down for a second straight month, however leading indicators show positive signs

Houston home sales fell for a second straight month in May as the impact of COVID-19 and related stay-at-home orders continued to play out throughout the market. Growing consumer interest in in-person open houses and property showings, as well as an increase in offers to purchase, demonstrated improving market conditions. The slumping energy industry limited buyers in the luxury home market, which affected the overall average price of single-family homes across the region. Predicting the future of the market remains a challenge, and just this week, the National Bureau of Economic Research declared that the United States has been in a deep recession since February.

Homes in every pricing category suffered losses, with the steepest declines at the low and high ends of the market. Homes priced below $100,000 dropped more than 37 percent while those priced above $750,000 plunged more than 56 percent. Year-to-date sales are now running 4.3 percent behind 2019’s record pace. Leases of single-family homes were the bright spot in May, jumping nearly 12 percent.

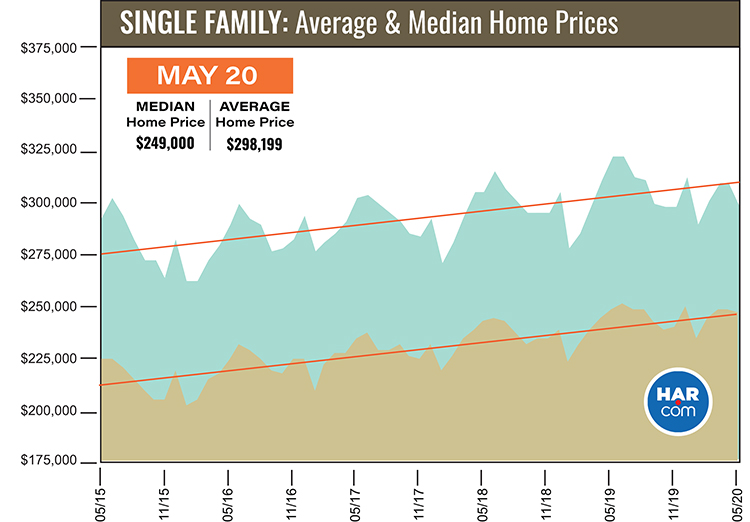

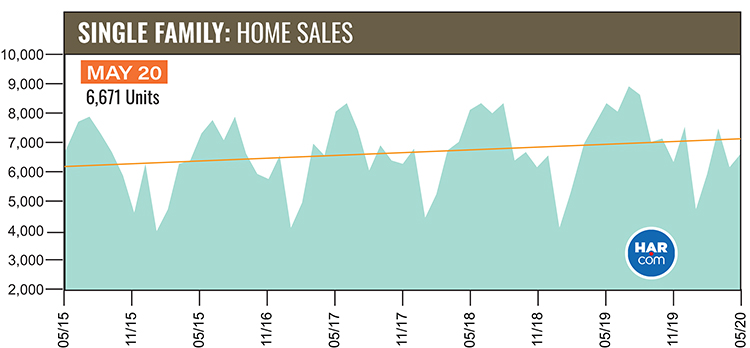

According to the latest monthly Market Update from the Houston Association of Realtors (HAR), 6,671 single-family homes sold in May compared to 8,359 a year earlier. That translated to a 20.2 percent decline – the second consecutive monthly decline since the pandemic struck the market. The lower sales volume, particularly among high-end homes, took a toll on average sales price numbers, however strong demand in the mid-priced market kept the median price of homes statistically flat. The single-family home average price dropped 7.4 percent to $298,199 while the median price dipped just0.4 percent to $249,000. The last time home prices saw declines was in January 2018.

Sales of all property types totaled 7,917, down 20.7 percent from May 2019. Total dollar volume for the month fell 25.9 percent to slightly more than $2.2 billion.

“May delivered another mixed bag of data for the Houston housing market given the ongoing coronavirus pandemic on top of strains in the oil patch and the broader recession,” said HAR Chairman John Nugent with RE/MAX Space Center. “We will eventually work our way through these challenges, and already see positive indicators in the form of strong rental activity, solid pending sales numbers and steady attendance at property showings across greater Houston. Historically low interest rates still make conditions appealing to would-be buyers.”

For the latest weekly report on housing market trends throughout the greater Houston area, please see the HAR Weekly Activity Snapshot for the week ending June 8, available HERE as a downloadable PDF file.

Lease Property Update

Consumers snapped up rental homes in strong numbers in May. Leases of single-family homes surged 11.9 percent year-over-year. However, leases of townhomes and condominiums slid 4.6 percent. The average rent for single-family homes was down 2.8 percent to $1,822 while the average rent for townhomes and condominiums was fell 4.6 percent to $1,586.

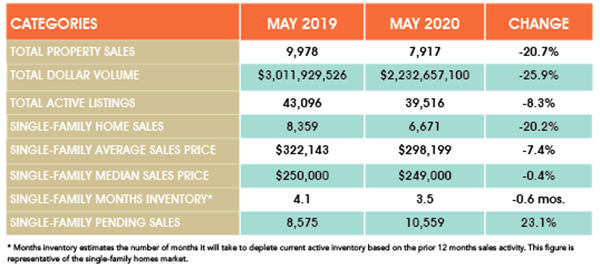

May Monthly Market Comparison

The lingering coronavirus pandemic layered on top of strains in the energy sector weighed heavily on the Houston real estate market for a second consecutive month in May. Single-family home sales, total property sales, pricing and total dollar volume all fell compared to May 2019. Pending sales, however, jumped 23.1 percent. Total active listings, or the total number of available properties, was down 8.3 percent.

With a slowdown in new listings to the marketplace, single-family homes inventory shrank, registering a 3.5-months supply in May versus 4.1-months a year earlier. For perspective, housing inventory across the U.S. stands at a 4.1-months supply, according to the most recent report from the National Association of Realtors (NAR).

Single-Family Homes Update

Single-family home sales fell 20.2 percent in May, with 6,671 units sold throughout greater Houston compared to 8,359 a year earlier. That marked the second straight monthly decline as a result of the COVID-19 pandemic with additional impact from the strained energy industry. On a year-to-date basis, sales now lag behind last year’s record pace by 4.3 percent. Pricing saw its first declines since January of 2018. The average price dropped 7.4 percent to $298,199. The median price was down a fractional 0.4 percent to $249,000.

Days on Market (DOM), or the number of days it took the average home to sell, rose slightly from 54 to 58. Inventory registered a 3.5-months supply compared to 4.1 months a year earlier and is below the current national inventory level of 4.1 months recently reported by NAR.

Broken out by housing segment, May sales performed as follows:

- $1 – $99,999: decreased 37.7 percent

- $100,000 – $149,999: decreased 26.1 percent

- $150,000 – $249,999: decreased 16.2 percent

- $250,000 – $499,999: decreased 15.3 percent

- $500,000 – $749,999: decreased 29.0 percent

- $750,000 and above: decreased 56.3 percent

HAR also breaks out sales figures for existing single-family homes. Existing home sales totaled 5,114 in May, down 28.2 percent compared to the same month last year. The average sales price fell 8.9 percent to $287,606 while the median sales price dropped 2.1 percent to $235,000.

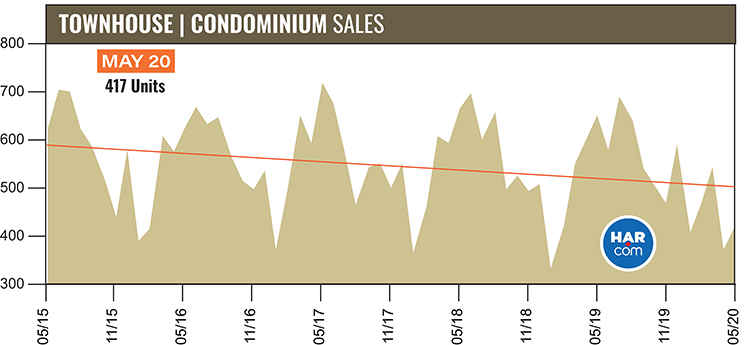

Townhouse/Condominium Update

Townhome and condominium sales, which took a hit in April along with the single-family segment, experienced another dramatic fall in May, plunging 36.0 percent. A total of 417 units sold compared to 652 one year earlier. The average price tumbled 2.3 percent to $206,146 while the median price rose 2.9 percent to $175,000. Inventory grew slightly from a 4.5-months supply to 4.6 months.

Houston Real Estate Highlights in May

- Single-family home sales fell 20.2 percent year-over-year, with 6,671 units sold, marking the second straight month of declines fueled by the COVID-19 pandemic;

- The Days on Market (DOM) figure for single-family homes grew from 54 to 58 days;

- Total property sales dropped 20.7 percent, with 7,917 units sold;

- Total dollar volume dove 25.9 percent to $2.23 billion;

- The single-family home average price fell 7.4 percent to $298,199, the first decline since January 2018;

- The single-family home median price was statistically flat at $249,000;

- Single-family homes months of inventory was at a 3.5-months supply, down from 4.1 months last May and below the national inventory level of 4.1 months;

- Townhome/condominium sales dropped 36.0 percent, with the average price down 2.3 percent to $206,146 and the median price up 2.9 percent to $175,000;

- Single-family home rentals jumped 11.9 percent with the average rent down 2.8 percent to $1,822;

- Volume of townhome/condominium leases fell 4.6 percent with the average rent down 4.6 percent to $1,586.